(FREE!) Fri 27 June 2025 - Paul Scott's Small/Mid Cap Value Report

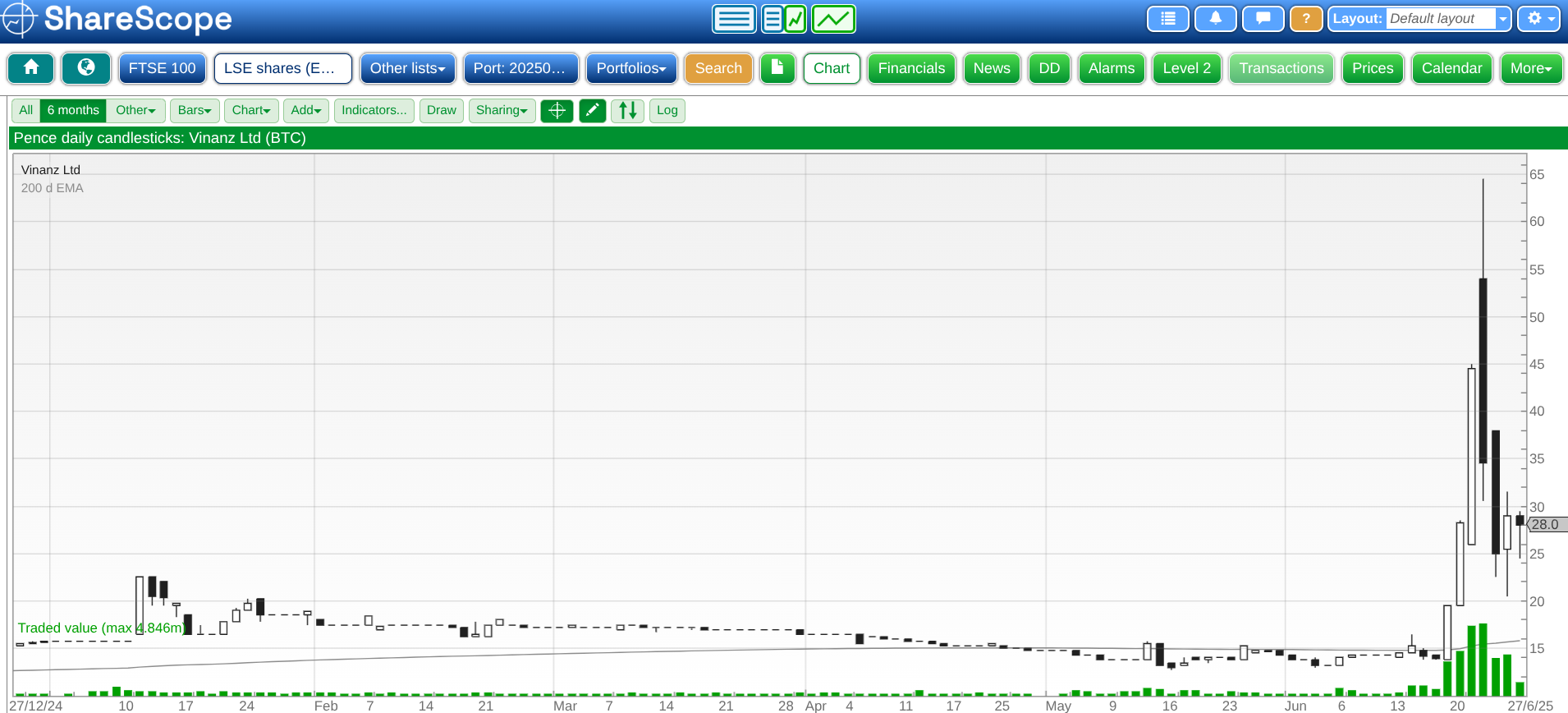

Placeholder for reader comments from 7am. Alun's Snapshot & Paul's summary table up at 07:53. Special report on Ai/Bitcoin mania - BTC.

Good morning from Paul & Alun!

Free report & podcast today, with it being Friday.

I’ve reversed the order today, with a special report from me on Ai/Bitcoin, and a worked example of this madness with Vinanz (BTC).

If you think this is interesting/useful, please could you do me a favour by Tweeting out, or ReStacking this report, to help drum up some new subscribers. Thanks in advance!

The usual report is further down, below this special report section.

Ai/Bitcoin Mania

I’ve been mentioning (mainly in my daily podcasts) the current mania going on with a dozen or so UK shares (some on AIM, others on Aquis) which have latched on to the current craze for Ai & Bitcoin.

A telltale warning sign is when companies issue RNSs typically titled “Bitcoin Treasury Policy”, or similar. Basically anything that talks about Ai combined with Bitcoin is almost certainly a load of ramped up junk, in my opinion.

The business model is not about Ai or Bitcoin, it’s actually for insiders to make money from creating a speculative mania in the shares.

The Ai/Bitcoin related announcements are usually pure hype, to create an exciting-sounding story that sucks in mug punters to buy the shares at wildly inflated prices from the insiders selling & banking their often rapid profits.

As with all speculative bubbles, early “investors” can make a killing, but the eventual end game is always the same - a collapse in value, and later stage mug punters who chased the gains, losing their shirts.

We saw a huge amount of this in 1998-2000, when all sorts of utter junk was floated, and achieved (temporarily) stratospheric valuations. I remember it well. The tech bubble of 1998-2000 went on for far longer than I imagined possible. Value investors looked increasingly foolish, as huge gains passed them by. Wave after wave of investors capitulated in value shares, and started chasing the latest story stock, which were typically connected with Tech/Media and Telecoms. The internet had just been invented, and nobody knew which stocks would be the winners.

An essential element of all speculations is some kind of new tech, and uncertainty over how it will develop commercially. This allows often outlandish stories and business models to be promoted at irrationally high valuations - because nobody can disprove the forecasts (if there are any - a good story doesn’t necessarily even need forecasts).

Eventually by March 2000 the tech boom peaked and a years-long, painful bear market began - with frequent powerful rallies, to lure people back in again for more losses - another common feature of financial mania.

Many of the story stocks at the bottom of the market ended up down 90%, then some time later, 95%. Many eventually ended up down 99%+ by 2002-3. Very few of the smaller, most ridiculous story stocks recovered much, if any of those losses. Whilst to be fair, a handful of tech giants did recover and soar to new highs (think the Mag 7 stocks now).

What’s going on at the moment with Bitcoin generally looks very much the same to me. These speculative bubbles happen throughout history, I’m sure you’ve already read books on this topic. To save time, I’ve just asked ChatGPT to summarise typical features of financial bubbles historically, and it came up with a useful summary -

Financial Speculations/Mania

1. Excessive Price Increases

Asset prices rise rapidly over a short period.

Increases are not supported by fundamentals (e.g., earnings, supply-demand dynamics).

"This time it's different" thinking often emerges.

2. Speculative Behavior

Investors buy based on expected price increases rather than value.

Herd behaviour: people invest because others are doing so.

Fear of missing out (FOMO) drives more participation.

3. High Trading Volumes

Dramatic increase in buying and selling activity.

Turnover rises among inexperienced or retail investors.

4. Leverage and Credit Expansion

Easy access to credit fuels speculative purchases.

Margin trading and debt-financed investments increase risk.

5. Media Hype and Popular Culture Involvement

Widespread coverage in news and social media.

Asset or sector becomes a household topic.

Influencers, celebrities, or public figures promote involvement.

6. New Market Entrants

Influx of inexperienced investors or speculators.

Market participation increases beyond traditional players.

7. Decoupling from Fundamentals

Valuations (e.g., P/E ratios) reach irrational levels.

Traditional valuation metrics are often dismissed or ignored.

8. Euphoria and Irrational Exuberance

Widespread belief that prices will continue rising indefinitely.

Sceptics are ridiculed or dismissed.

9. Warning Signs Ignored

Analysts or economists warn of unsustainable valuations.

Market participants dismiss or rationalise away risks.

10. Crash or Sudden Correction

Triggered by a loss of confidence, economic news, or liquidity issues.

Sharp, often rapid price decline follows.

Panic selling replaces euphoria.

Classic Examples:

Tulip Mania (1630s)

South Sea Bubble (1720)

Dot-com Bubble (late 1990s–2000)

U.S. Housing Bubble (2006–2008)

Cryptocurrency surges (e.g., Bitcoin in 2017, 2021)

Back to Paul now - thank you Ai, and yes I am aware of the irony here, where I used Ai to help me write an article exposing valuation bubbles in Ai shares! ;-) But they are two separate things. A useful tool does not necessarily make a pile of Bitcoin worth 15 times its market value, as I explain below.

Book suggestion

I’ve mentioned it before, but I’ve read this admirably concise book (below) about 5 times now, it’s an essential reminder, particularly whenever market conditions become euphoric. Also it’s entertainingly written, with some lovely old-style phrases, and sharp wit. A small paperback, it’s easily digested, ideal for the summer holidays. If you have even less time, just read the last chapter, which amazes me at how a book written in the 1950s could be so relevant today, concerning the latest speculative mania, in Bitcoin/Ai stocks.

As it’s quiet for news today, I thought it might be worthwhile to examine the financial fundamentals of one such Bitcoin/Ai shares on the London Main Market (most others are on AIM or Aquis).

Picking one from news today, let’s look at this -

Vinanz (BTC)

[intention to change name to: London BTC Company]

Down 9% to 26.5p (11:57) £74m - Bitcoin Purchase - Paul - RED

Today’s RNS just says that it has bought 5.85 Bitcoin, costing $631k.

Its total holding of Bitcoin is now 65.03 units, avg purchase price $98,212, so total cost $6,386,709, or £4.65m (remember this number!)

Vinanz’s CEO explains the business model -

“Our goal remains simple: provide London Stock Exchange Main Board listed market access to a growing pool of directly held Bitcoin, with full transparency and audited custody."

Vinanz was previously listed on Aquis in April 2023, then moved to the London Main Market on 13 Jan 2025.

At the time its Directors were David Lenigas (Chairman), and Jeremy Edelman (FD), names which ring a bell.

Its activities were mining bitcoin “through third-party cryptocurrency mining providers” in the US & Canada.

The most recent accounts are its Annual Report for the 18 months to 28 Feb 2025

Strategy -

“Our dual mandate is clear and deliberate: to mine as much Bitcoin in North America as profitably as possible, and to acquire and hold Bitcoin in treasury as a strategic asset for long-term appreciation”

Therefore, to assess the company fundamentals all I need to find out is -

How much profit does it make from bitcoin mining, and

What are the balance sheet net tangible assets?

Bitcoin mining - £1.0m revenues in 18m to 2/2025, which generated a gross profit of £172k. So I think we can safely ignore this part of the business as being irrelevant. In any case, bitcoin mining is chasing vanishing returns, with increasingly heavy costs, hence why it’s mostly seen as a waste of time & money unless you have access to free electricity. That’s what people have told me anyway.

P&L for 18m to 2/2025 - £957k revenues, and a £-15.6m loss before tax, mainly caused by a £14.0m share based payment charge. Stripping that out would give a loss before tax of £-1.6m, mainly caused by hefty administration costs of £1.9m.

Balance Sheet - is it groaning with net assets then? (to justify the £74m market cap, it must be surely?)

Err, no. At 2/2025 NAV was just £1.8m, which included £855k cash, and £399k “digital assets”- almost all a bitcoin wallet (per note 10)

Going Concern - “material uncertainty” exists due to $4m bridging loan secured post year-end.

Who owned it?

As at 28/2/2025 it’s mainly owned by the Directors, and advisers -

This will have changed somewhat since the recent fundraise.

Directors’ Remuneration - is almost comical - but they’re certainly motivated to ramp the share price up to the max with these options -

Post balance sheet events -

Here’s a list of all RNSs since the 28/2/2025 period end (with thanks to investegate.co.uk) -

I don’t want to waste yours or my time ploughing through all of these, as I’ve got the measure of this share already (massively over-priced, hyped up junk).

But for the sake of completeness, I’l pick out the ones which change the financial position from the £1.8m NAV as reported on 28/2/2025.

Here we are -

14/5/2025 - Institutional $4m bridge funding (loan convertible into equity at lender’s option) secured “to expand bitcoin business”.

This suggests to me that the £855k year end cash was probably running low (unsurprising given the admin costs).

It can draw $2m funds, with a further $2m being subject to “certain conditions”, which sounds like it might be a dual listing on NASDAQ (I’m not making this up, honestly!)

Who is the lender? We’re not told.

Terms? Repayable after 12 months, interest is a modest 5% pa.

Conversion terms: the lower of -

25p/share (share price currently volatile, at 26.5p)

95% of the share price low in previous 10 trading days when the lender exercises its option (not the average share price, but the lowest single day’s share price)

No conversion within first 90 days of agreement (which takes us to c. mid-August), unless at 25p

Cannot go above 5% of the total company’s shares.

That’s quite complicated, but it seems to be saying that the lender can convert debt to equity at a maximum price of 25p. In reality I doubt they would convert into equity unless the share price was substantially above 25p, as there would be no point.

If the future share price is below 25p, then the lender can pick its spot, and get a 5% discount to the recent share price low. So that’s looks very favourable terms for the lender (cake, and eating it), but at least the 5% cap stops excessive dilution.

So I imagine the $2m drawn down helps cashflow a bit, but of course it doesn’t strengthen the balance sheet at all, as it’s a loan.

Plus of course the $4m loan is actually only $2m for now.

19/5/2025 - Bitcoin Purchase - looks like the new funding was put to work quickly, buying $1.75m of Bitcoin at an average price of $103,341 (fairly similar to the current market price c. $107,100. Remember this purchase was using borrowed money, so if Bitcoin say halves in price, then Vinanz has a problem! Strangely, the announcements says this was its “first Bitcoin purchase”, which contradicts the accounts saying it already held £399k in a bitcoin wallet.

EDIT: Many thanks to marben100, who points out in the comments below that the existing Bitcoin might have been mined by Vinanz, instead of being purchased. That makes sense, great point, thanks marben100! End of edit.

12/6/2025 - Intended to raise £1m through the WRAP system (Winterfloods), 7.3m new shares at 13.75p issue price (now comfortably in profit, and possibly the people who are now selling to bank their gains?).

17/6/2025 - Actual fundraise enlarged to 22m new shares at 13.75p, raising £3m before costs through WRAP. So significantly over-subscribed, and they’ve grabbed as much as they can, very sensibly. Plus another £550k raised from a direct subscription, grand total equity fundraise (before costs) of £3.6m.

24/6/2025 - Buys 37.72 more Bitcoin, average $102,056, costing $3.85m (c.£2.8m) - the bulk of the recent equity fundraise.

27/6/2025 - Buys 5.85 more Bitcoin at $107,863, cost $631k (c.£461k)

Paul’s opinion - the market cap is insane, it makes no sense whatsoever.

It’s currently valued at £74m market cap.

The operating business (bitcoing mining) is de minimis, so we can forget about that as it’s worth nothing effectively.

That only leaves assets, which are a grand total of 65 Bitcoin, currently worth $7m, or £5.1m. There’s no significant profit on the purchase price, a little bit, but there’s also downside risk on them falling in value of course.

That’s it! There’s nothing else.

What is a reasonable valuation of Vinanz on fundamentals (excluding the hype)?

I’d say nothing for its bitcoin mining operation.

You might want to pay par with NAV, which is essentially just the £5.1m Bitcoin, as I don’t think it has any significant cash left over - and would in any case dissipate through admin costs.

So Vinanz is worth maybe £3-5m, since a rational value investor would want a discount to NAV, due to all the overheads.

Hence at £74m market cap, Vinanz is overvalued by a factor of c.15x

By my calculations, it’s fundamental worth is at best 1.8p per share.

Almost all the current share price is pure hype. I haven’t even worked out the dilution from the massive Director share options.

It’s not even pretending to do anything clever! It just raises cash, and buys small amounts of Bitcoin with it. There’s no value add from Vinanz at all, it’s just a large & unnecessary overhead.

You could recreate Vinanz yourself by just buying £5.1m of Bitcoin for £5.1m. Why would you want to pay £74m for £5.1m of Bitcoin?

This thing is totally nuts.

It won’t end well, I can tell you that for sure. But in the meantime, the craziness could continue, who knows for how long?

Click here for my special signup deal for new accounts at ShareScope. It’s terrific software, and helps fund our writers here from commissions earned.

It’s “Free Friday”, when my article and podcast go out free, so that thousands of free substack accounts can have a small sample of the work we do here. There’s a steady flow of people upgrading to premium (only £100 per year, or £10 per month) - which is nothing considering all the great investment/trading ideas that we publish every morning (eg. yesterday we flagged, pre-market open, that Volex (VLX) had just published forecast-beating results, a trade that made people 18% in one day, as the price barely moved at the open, so there was time to jump in early at a favourable price).

After a long bear market, it’s great to see people making money again in UK small-mid caps. Let’s hope it continues! More takeover bids seem likely, since the UK market still looks significantly undervalued compared with valuations overseas (esp. USA) and in private markets. So rich pickings are spread out before us, with plenty of decent UK shares still trading at very attractive low valuations - opportunities galore (as I’ve been saying for a long time)!

The constant doom & gloom from the mainstream media is misleading, in my opinion. Things are little better in most Western countries, worse in some cases.

NIKE

In the US, NIKE shares surged last night, as it announced a better than expected outlook. It closed at $62.5, but rose to $69.25 in after-hours trading.

That’s had pleasing read-across this morning to two of my positions, JD Sports (JD.) up 6% to 86p, and Zotefoams (which makes special soles for high end NIKE trainers, and NIKE is its largest customer), which has been bouncing this week from a recent spike down.

Both JD and ZTF still look remarkably cheap on fundamentals, to my eyes. There’s a discussion on this topic in the reader comments below, thanks to those that posted.

MrC's Smallcap Sweep: End of a week of crypto craziness and Bitcoin babbling

JIM, GLV, SEE, PR1, TAP, NARF, DPP, HERC, EARN, LIKE, DEVO, BBSN

Note: 👍 👎 ❓mean positive, negative or mixed/confusing. No symbol = neutral. All Alun's opinion only on each specific RNS, not the company itself.

◄Jarvis Securities (JIM)► 👎 pushed back FY end from Dec24 to June25 due to financial uncertainty. The sale of the retail execution-only brokerage business is in doubt because certain conditions will not be satisfied. The buyer, ii, says it will proceed but JIM will not be able to satisfy going concern hurdle in FY24 if it doesn't. [SP=16.83 Cap=8m]

◄Glenveagh Properties (GLV)► 👍 £20m max buyback. [SP=1.7 Cap=889m]

◄Seeing Machines (SEE)► 👍 Guardian Generation 3 trial with Mitsubishi Electric in North America. CEOs warble a duet about team synergy, leveraging relationships and achieving groundbreaking results. [SP=2.68 Cap=131m]

◄Pri0r1ty Intelligence (PR1)► launch of a AI-powered Bitcoin and major cryptocurrencies integration solution, Pr1bit. The Pri0r1ty advisor agent "continuously monitors and analyses Bitcoin holdings while providing actionable insights". CEO warns "Those who don't integrate [Bitcoin] will get left behind". I'm quaking in my boots. I won't be filling them however. [SP=6.17 Cap=9m]

◄Tap Global (TAP)► lists on AIM today. Does it involve crypto? Yes, of course it does. It's already profitable! Surely some mistake! CEO trills "So today is not about validation; it's about amplification." That's a new one. [SP=NA Cap=NA]

◄Narf Industries (NARF)► launches Ranger, a powerful new software platform that helps organisations identify hidden threats in open-source software. It puts Narf "at the forefront of a fast-moving cybersecurity frontier". [SP=0.49 Cap=8m]

◄DP Poland (DPP)► FY-Dec. What a late delivery. That balance sheet will be stone cold! Q2 'positive' with rev up. [SP=9.5 Cap=90m]

◄Hercules (HERC)► buys Advantage NRG, a specialist labour supply company for overhead electrical transmission lines for £10.2m + £5.5m contingent. Getting s £6m loan from a related party to help pay for it. [SP=43.8 Cap=35m]

◄Earnz (EARN)► 👍 FY-Dec. Exec Chmn Bob Holt says business trading is ahead of target. [SP=4.4 Cap=5m]

In line: LIKE, DEVO, BBSN

Here’s what I’ve done so far, at 07:51 (this is almost everything actually, as Fridays are so quiet, we usually have 3-4x this amount in the early table on Tue, Wed, Thu) - v2 with early price moves -

Zotefoams - ZTF (I hold): "Nike Rises After Predicting Its Sales Slump Has Hit Bottom

Nike's yearlong sales decline is easing, with the company expecting a smaller sales drop in the current quarter than anticipated.

Nike is taking steps to mitigate tariffs, including "surgical" price increases and reallocating manufacturing from China to other countries, with plans to reduce China's share of Nike footwear imports to a high-single-digit percentage by the end of its fiscal year."

Source: Bloomberg

https://www.bloomberg.com/news/articles/2025-06-26/nike-s-sales-beat-signals-the-sportswear-maker-s-slump-is-easing?srnd=homepage-americas

A subscription site but I believe there are three free article views per month.

Good news related to Revenge taxes and Remittance taxes-

Bessent has asked Congress to remove the Revenge taxes (section 899) from Trump's tax bill.

https://www.ft.com/content/5d99c735-97e4-4574-be16-81da32ac48eb (subscription)

https://thehill.com/business/5371931-bessent-calls-on-congress-to-scrap-revenge-tax-from-trump-bill-after-g7-strikes-deal/

Additionally, remittance tax clarifications indicate that personal transfers from a US brokerage or bank account to a personal non-US bank account won't incur a 3.5% excise tax. (N.B. this source may not be reliable): https://www.pstein.com/blog/senate-defangs-the-new-u-s-remittance-transfer-tax/