Fri 11 July 2025 - Paul Scott's Small/Mid Cap Value Report

Alun's snapshot at 07:32. v1 summary table at 07:58. Starters: BP., OTCMKTS:TSWCF, WHR, FUM Mains: ASLI, PMI, ACSO, SATS

Good morning from Paul & Alun!

Fridays reports & podcasts are free, because I don’t have to pay any other writers on Fridays.

Quiet for news again today, as usual for a Friday.

No paywall today, as it’s Free Friday - sorry the email went out a bit late, I keep forgetting to tick a checkbox on substack.

Update on ASLI, from Was Shakoor

My friend Was is a special situations investor, including distressed bonds, REITS, infrastructure funds, etc, where he’s been highly successful over many years.

He kindly wrote a bonus article here on 30/11/2024, flagging a low risk special situation, called abrdn European Logistics Income (ASLI). The investing case set out by Was is that ASLI was winding itself up, and looked to have a reasonably good, low risk likely return for shareholders in a reasonable timeframe.

He updated us here on 24/1/2025, saying that things were progressing well.

Today’s Update -

Was has just sent through his current thoughts on ASLI after a positive RNS this morning -

“ASLI is out with a super update today, announcing 2 disposals (€66.5m), at a 10% premium to Q1 2025 valuation.

ASLI has already paid back 4p/share as a capital return, reflected in the 84.5c (euro) valuation given here:

28/5/2025 RNS: Unaudited Net Asset Value at 31/3/2025

Since then, the Euro has moved in ASLI's favour, so that 84.5c is worth about 73p now, without any premium achieved in sales. Remember, this is AFTER 4p/share has already been returned prior to that date.

I was very conservative when I wrote my first article, planning for a 70p total return, assuming they'd have to accept a discount to NAV. I think that will be comfortably beaten now.

73p/share - the last reported NAV - looks achievable, especially since all liquidation costs are built into that figure. I suspect they might do better than that, given today's update.”

So far, so good! Thanks for Was’s contributions here, and I hope some readers have made a few quid on this one. Good to see it playing out better than expected.

MrC's Smallcap Sweep: accesso queues for a slide

ACSO, PMI, SVNS, WSG, ASLI, VANQ

Note: 👍 👎 ❓mean positive, negative or mixed/confusing. No symbol = neutral. All Alun's opinion only on each specific RNS, not the company itself

◄accesso Technology (ACSO)► 👎 warns FY-Dec rev at the lower end of guidance after weak demand at venues in H1. FY26 - a major customer does not intend to renew one of its agreements. Talks on other agreements continue. Expects gross profit hit of c.$6m. However there will be significantly improved commercial terms in the remaining agreements. [SP=476 Cap=191m]

◄Premier Miton (PMI)► Q3 AuM £10.5bn down £0.2bn YoY. Net outflows £173m, an improvement from £221m in Q2. "A stabilisation in conditions during the second half of the year would provide a more constructive backdrop for converting our strong new business pipeline across fixed income, absolute return, and several equity strategies into positive flows." Dream on! [SP=72 Cap=120m]

◄Solvonis Therapeutics (SVNS)► 👍 £1m subscription by three shareholders at 0.3p, a 3.5% premium, to accelerate its AI drug discovery programme. [SP=0.29 Cap=17m]

◄Westminster (WSG)► ❓ gets £500k 6 month credit facility at 0% from lender Pantheon. Latter will also waive interest on funds drawn on its convertible agreement. Why so generous? Strike on existing drawn convertibles cut from 3p to 2p, a 23% discount to the SP. [SP=2.52 Cap=11m]

◄abrdn European Logistics Income (ASLI)► 👍 sells 2 warehouses for €66.5m, 10% over book. Expect next wind-down distribution in Aug. [SP=62 Cap=255m]

In line: VANQ

v1 summary table - v2 with price moves 09:08 - updated 11:33 & 11:48 & 12:47 & 13:39 -

In more detail below -

Tao Alpha (SATS) - Q1 Results - STEAMING TURD (with flies)

Accesso Technology (ACSO) - Profit Warning - Paul - PW/ AMBER

Premier Miton (PMI) - Q3 AuM Update - Paul - AMBER

Paul’s Section:

Tao Alpha (SATS)

Name change pending to: Satsuma Technology

Down 23% to 7.5p (£35m) - Q1 Results - Paul - STEAMING TURD

Released yesterday at 16:06, it’s produced “interim results” but for a 3-month (not 6-month) period.

Highlights -

Revenue £1k!

Loss before tax £-115k

Other income £375k - a revaluation uplift on its investment in 17% of Roundhouse Digital, an unlisted company.

Total comprehensive gain for the period £260k

So clearly there’s basically nothing here, apart from a small investment in another company.

Balance sheet - nothing here either to speak of, as at 31/5/2025.

Cash? It was just £6k!

Current assets of £25k, dwarfed by current liabilities of £524k (mostly accrued Directors’ fees).

NAV £2.3m, less intangibles of £2.2m, so NTAV is only £0.1m, and that’s assuming we take the “investment” as being worth book value of £625k.

Held just £33k of cryptocurrency at 31/5/2025!

Hence this company is effectively a shell company with next-to-nothing in it. How does that sit with a market cap of £35m then? It’s a speculative bubble.

Share options - 454m shares in issue at 31/5/2025, with 129m share options in issue, so 28% potential enlargement of the share count there, way above the generally accepted maximum of 10%.

It says further down that exercising of warrants at 2.5p the share count rose to 472m on 9/7/2025.

Director fees are very low - good job, as the company didn’t have the cash to pay them, with £301k showing as an accrual on the balance sheet.

Going concern note - relies on it having £1.67m in convertible loan financing to continue operating as a going concern.

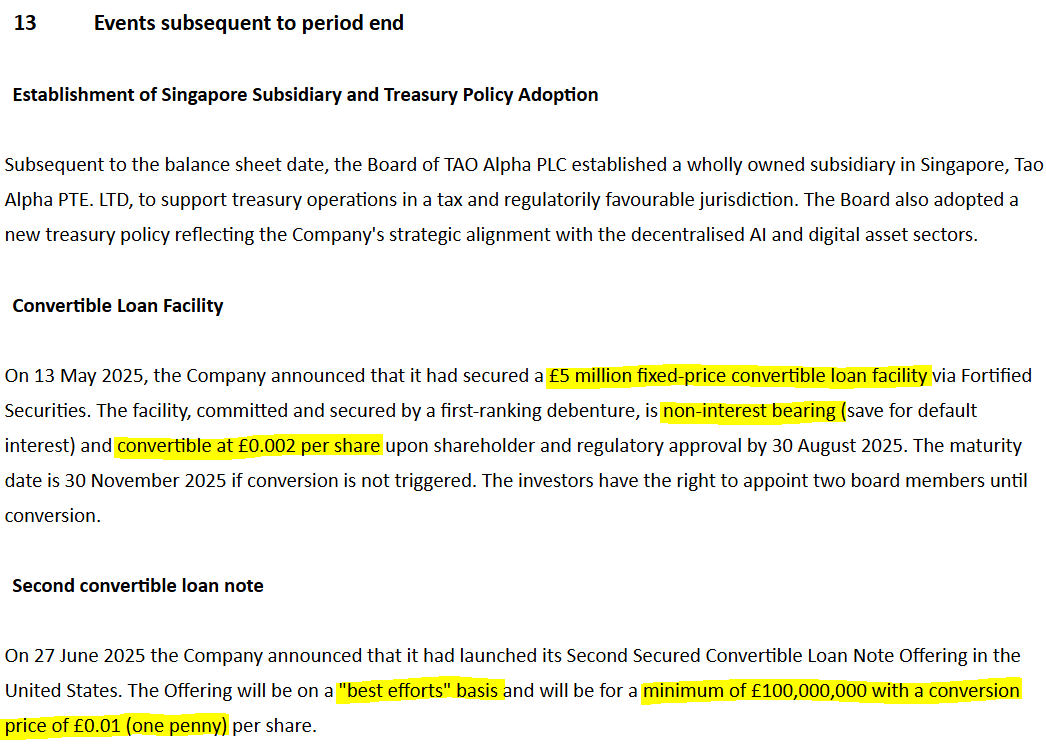

Post period end - something interesting must have happened since 31/5/2025, for this company to be valued at £35m, as I would struggle to justify a valuation of more than zero for the numbers at 31/5/2025.

To save me typing here’s a screenshot below - note the colossal dilution that would occur at a huge discount to the 7.1p current share price, if these loans are converted into equity at just 0.2p (first tranche) for £5m, so that’s 2.5bn new shares by my calculations.

The second tranche of £100m (I’m not making this up!) at 1p/share would be 10 billion new shares if fully converted.

Paul’s opinion - this is almost comical.

Anyone buying this share at 7.2p is clearly out of their mind.

There’s gigantic potential dilution coming if the £5m convertible loan is approved at a shareholder vote on 30/8/2025.

Then the money to buy Bitcoin might come in, with the investor eligible to convert into equity at just 0.2p per share (a 93% discount to the current share price), and receive 2.5 billion new shares, largely wiping out existing holders of the existing 472m shares.

I would describe this company as a scam, but actually they’ve published all the information, so it’s open to scrutiny, and it only took me less than an hour to figure out that this share is almost certain to collapse in value in the coming months. So it’s got to be a steaming turd, one of the worst I’ve ever seen actually.

Oh and a message to Tom Winnifrith - don’t steal my article again, it’s copyrighted, and is NOT for copy pasting onto your website!

Recent chart since the ramp started -

I’d give it a few weeks/months before this is back under a penny a share, or thereabouts.

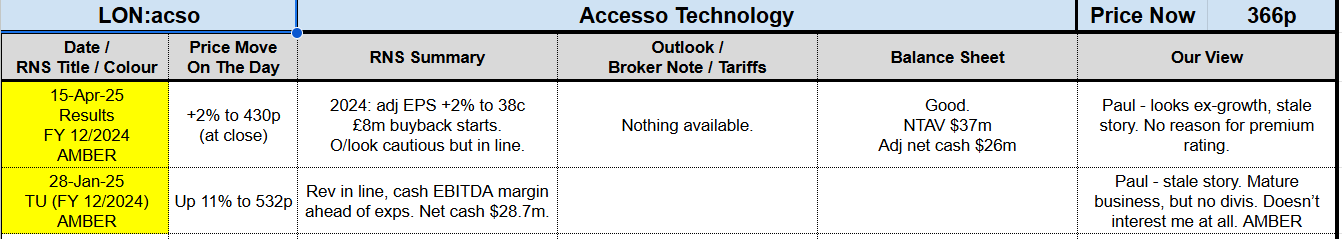

Accesso Technology (ACSO)

Down 24% to 363p (144m) - Trading Update (profit warning) - Paul - PW / AMBER

“accesso Technology Group plc (AIM: ACSO), the premier technology solutions provider for leisure, entertainment, and cultural markets, today provides the following update on its ongoing commercial performance.”

This share has been around for a long time. Originally called Lo-Q, it was a massive multibagger, going from a few pence up to almost 3000p/share in late 2018, before the bubble burst, and repeated attempts at rallying have since always conked out.

How about this for the all-time chart below, which as Rebecca points out wryly in the comments, seems to very appropriately mimic one of the rides at the theme parks it provides ticketing & queuing software for!

Our previous thoughts here - not one of my favourites, it’s fair to say -

Profit warning -

Bad luck to holders, as a -24% drop today seems to have stuck, with it not managing to bounce at all so far (at lunchtime). It’s often the way with profit warnings, that the initial market reaction seems brutal, but it has to fall to a level where buyers decide it’s not worth selling, and the price becomes attractive enough for new buyers to come in and mop up the sells. Then we often discover a few days later that the premium broker notes (which we don’t get to see) have slashed earnings forecasts so much that it actually isn’t a bargain after all. This is why I try (but don’t always succeed!) to resist the urge to buy immediately on a profit warning.

Resetting the chart from long-term to very short-term, you can see the detail below in the last 2 weeks, with candlesticks set to 15-minutes, and note the elevated volume today, green bars at the bottom, as you would expect on a profit warning -

What’s gone wrong?

This is for H1, 6 months to June 2025 - which doesn’t sound too bad to me -

Softer revenues than expected (“at the lower end of our anticipated guidance range”) - not stated what that range is, annoyingly.

Why? “Softer than expected attendance” at customer sites.

Seasonality is emphasised, with June, July & August peak trading months.

“Cash EBITDA” margin maintained at c.15%, due to “cost discipline and operational efficiency”.

Major customer - I suspect this bit has caused the bigger damage to share price today -

Big customer has notified it won’t be renewing parts of its contracts beyond 31/12/2025.

Impact will be $6m pa reduced gross profit, and rather confusingly it says -

“as the revenue lost is meaningfully offset by significantly improved commercial terms in the remaining agreements with the customer.”

Pipeline - sounds nice, but no specifics are provided -

Encouraged by its strength.

“Notable improvement in our commercial win rate”

“Significant uplift in new wins”

“expect the positive commercial momentum to strengthen further into the final quarter of the year.”

Outlook - not good, as it sounds like they’ve not got much visibility -

“2026 outlook guidance

The Group will update the market on guidance for 2026 once trading conditions become clearer, further progress is made on our current commercial momentum, and the contract discussions with the major customer are concluded.“

Balance sheet - nothing said today, but it was fine when last reported, here are my notes from 15/4/2025 re 12/2024 figures -

Good.

NTAV $37m

Adj net cash $26m

Broker notes - nothing new. There is a very detailed note from Hardman dated 16/5/2025 which might be useful for background about the business, although obviously now take the forecasts as outdated.

Hardman has gross profit of $128m forecast for FY 12/2026. So losing $6m from the customer mentioned above doesn’t look too bad.

However, 2026E operating profit was $23.8m, so losing $6m gross profit could knock profit back by a quarter, if it flows straight down the P&L. Hence the key question is what cost savings will ACSO be making to mitigate the lost gross profit from 2026? We don’t know at this stage.

Paul’s opinion - I haven’t got enough information to be able to judge. So all we can do is to wait a few days, and see how the broker consensus forecasts change.

This doesn’t sound a disaster today, and I don’t see any insolvency/dilution risk due to the strong balance sheet with net cash.

But equally, why would I want to buy this share, given it sounds they don’t have a lot of visibility? I’d rather wait until the peak trading season has passed, and re-assess it once we have proper guidance & revised forecasts.

So probably sticking at AMBER for now makes sense, but that’s more “don’t know”, rather than anything positive about the company. I definitely am not interested in buying any personally.

EDIT: I asked Ai to come up with some jokes about rollercoasters, and this was its pitiful offering -

“10. What did the Frenchman yell on the roller coaster?

Yes!”

Maybe I’ve missed some clever play on words there, but I don’t understand that at all. Michael McIntyre’s career looks safe from the threat of Ai for the time being anyway.

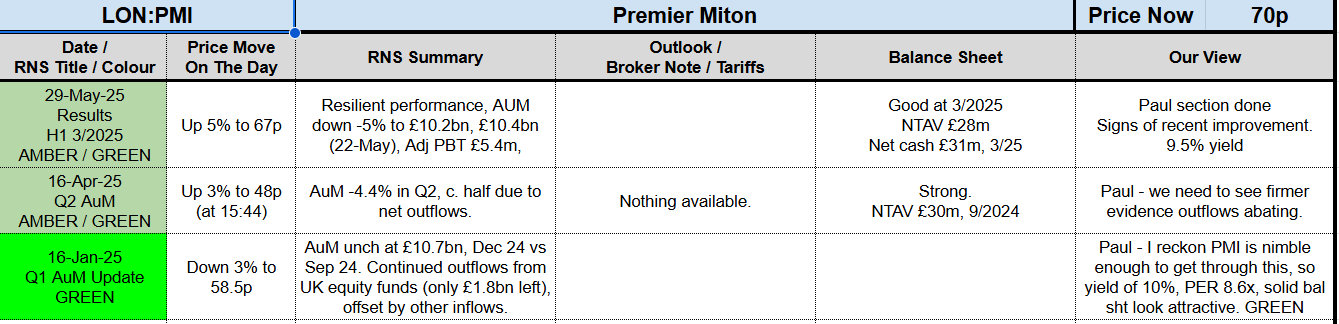

Premier Miton (PMI)

Down 1% to 70.5p (£111m) - Q3 Assets under Management (AuM) Update - Paul - AMBER

Fund management shares have had some lovely bounces so far this year. Whether they’ll stick though, I’m not convinced. The big issue is obviously fund outflows, with clients understandably pulling their money out of poorly performing, open ended funds - although most fund managers seem to be reporting that they’re over the worst for client outflows.

Our previous thoughts -

Today’s news -

“Premier Miton Group plc (AIM: PMI) today provides an update on its unaudited statement of Assets under Management ('AuM') for the third quarter of the current financial year ending 30 September 2025 (the 'Quarter' or 'Period').”

Q3 is April to June 2025.

“£10.5 billion AuM as at 30 June 2025”

That’s down c.2% from the last year end of 30-9-2024

However, there seems to be an improving more recent trend, from the above table we have:

31/3/2025: £10.2bn

22/5/2025: £10.4bn

30/6/2025: £10.5bn

Of course the AuM figures combine two elements - client net fund in/outflows, and market price movements in the underlying investments.

This is helpfully itemised, with Q3 showing net client outflows of £-173m, more than offset by investment performance of +£441m.

Hence the overall change in AuM for Q3 is £10,201m AuM at 1/4/2025, to £10,469m at 30/6/2025, up 2.6%

Fund performance sounds reasonable -

“Positive investment performance in the Quarter with over 70% of funds performing above median over the past three and six months”

Clients are still withdrawing funds overall though -

“Net outflows of £173 million for the Quarter, an improvement from £221 million in the prior quarter”

The commentary focuses on selecting positive-sounding snippets of information, which is usual for fund management company updates, so I won’t repeat it here.

Outlook - strikes me as uninspiring -

"From a market perspective, the Quarter was marked by heightened volatility following the introduction of US tariffs and ongoing tensions in the Middle East. While the full implications remain to be seen, a stabilisation in conditions during the second half of the year would provide a more constructive backdrop for converting our strong new business pipeline across fixed income, absolute return, and several equity strategies into positive flows."

Valuation - nothing is said about performance vs market expectations, so I’ll assume it’s in line.

ShareScope has broker consensus at 5.65p (down 6% on LY) for FY 9/2025, hence a PER of 12.5x at 70.5p per share. That strikes me as looking a fair valuation.

Following years show forecast earnings growth of 16% to 6.57p (9/2026) and 20% to 7.88p (9/2027). How realistic are those earnings growth figures though? What is going to drive improving profits, when the recent trend has been for profits to drop considerably?

It’s nicely displayed below in the ShareScope mini charts -

Find mini charts here -

Presumably, to get earnings rising again would require significant increases in AuM.

Dividends - the consensus dividend forecast is 6.0p, not quite covered by earnings forecast of 5.65p.

Hence I would work on the basis that the very generous divis might be curtailed somewhat in future perhaps? That’s often the trouble with very high yields.

Balance sheet - is good, as with most fund managers.

When last reported on 3/2025 the key numbers were -

Good at 3/2025

NTAV £28m

Net cash £31m, 3/25

As you can see, the business model is asset-light (no need for much fixed assets and no physical inventories), so slightly more than all the NTAV is represented by cash, hence it’s very safe - no risk of dilution or insolvency.

Paul’s opinion - slightly disappointed. Markets have bounced in April-June, so I would have expected AuM to rise. Disappointing to see continuing net client withdrawals.

As I’ve mentioned before, the thing I like about PMI is that it’s relatively small, so new fund launches could have a greater positive effect, and turn it around more quickly than a lumbering large fund manager, saddled with underperforming funds that are too big to liquidate or turnaround.

PMI shares have had a smashing bounce of late, and with the valuation now looking about right, I’m dropping from A/G to AMBER.

It was a bargain in Mar-Apr 2025, but looks less of a bargain now, after a big rebound. One to top-slice or bank profits maybe? Or hold for the divis, but don’t expect it to necessarily maintain the 8.4% yield. Your money, your choice!

Some say that active fund managers might now be a dying breed, given that most of them have performed so badly in the last few years. Hence I’m sceptical the valuation here has the scope to recover former glories.

Click here for my special signup deal for new accounts at ShareScope. It’s terrific software, and helps fund our writers here from commissions earned.

ASLI - Hat tip and thanks to Was for doing that bonus article - its a trade that’s worked out very nicely so far - appreciate the work that went into that on our behalf!

NAV at 72p now looks distinctly light given the 10% premium made on recent sales. If we include income over the next 6 months then feels like we should get between 76 & 79p in total. Probably take another 8 or 9 months to achieve that but even here at 64p a lower risk 20% return (25% annualised) remains on offer.

pretty quiet out there:

ACSO revenue warning after weak H1, delivery risk for critical Q3 ⬇

PMI outflows slowing to £173mn from £213mn previous quarter ➡

BP updates Q2 guidance, now expects: ➡

- higher upstream production

- strong oil trading result

- slightly lower net debt

- asset impairment charges $0.5 - $1.5bn

Tariff headlines again overnight, as Trump decided to randomly threaten Canada with 35% tariff rate on non-USMCA products. this gives PM Carney 3 weeks to keep working on a solution to avoid this for the August 1st deadline.

the issue here is Canada already made concessions by removing their Digital Services Tax after Trump complained; and yet he still hits them with this unexpected threat.

market reaction an initial drop in S&P futures, but recovered most of the drop already, as nobody really expects Trump to follow through on threats now. we can expect something similar re the EU today, I suspect.