Fri 22 Nov 2024 - Paul Scott's Small/Mid Cap Value Report

Mains: GAW, NWOR, RTC, DFS, MBH, TFW, PAY

MrC's Smallcap Sweep: Cracking PR

FIPP, ZNT, WEB, INSG, LPA, GAW, IES, LTG, BELL, QED, TAVI, MBH, RTC, DFS,NWOR

◄Frontier IP (FIPP)► £3m placing and subscription at 28p, a nil discount, "to provide enough headroom for the Company to be able to deliver on the portfolio realisations it anticipates achieving in the near term" and keep the lights on. £1m retail offer. Also FY-June includes a material uncertainty going concern stmt and portfolio update. [SP=27.37 Cap=15m]

◄Zentra (ZNT)► (was One Heritage) has completed the transactions outlined in the Strategic Update of Oct. Moving to AQSE Growth Market on 11 Dec. [SP=9.4 Cap=4m]

◄Webis (WEB)► proposes delisting to "reduce costs and protect shareholder value as the Group seeks to grow its business in North America and deliver on strategic goals...Despite the best endeavours of the Board and its management team, the performance of the Group has not improved in-line with expectations, and the losses for the financial period ending May 2024 are expected to be approximately $1m". [SP=0.48 Cap=2m]

◄Insig AI (INSG)► wins £80k contract from a London based alternative investment manager to migrate its data into the cloud. [SP=13.5 Cap=16m]

◄LPA Group (LPA)► guides FY-Sep rev up 10% to £23.8m but order intake £17.3m was down 32% as a result of previously flagged delayed rail projects. U/L pretax in line with previous guidance of breakeven. [SP=57 Cap=8m]

◄Games Workshop (GAW)► trading since Sept update is ahead of expectations. Guides H1-Dec core rev £260m+ and licensing revenue £30m+. Pretax £120m+. [SP=11690 Cap=3852m]

◄Invinity Energy Systems (IES)► proposed redomiciliation from Jersey to the UK is progressing in line with guidance. [SP=12.5 Cap=55m]

◄Learning Technologies (LTG)► PUSU extended to 6 Dec. Due dil concluded. I hold. [SP=90.2 Cap=714m]

◄Belluscura (BELL)► $4m three year credit facility to cover accounts receivable, purchase order, inventory and cash flow financing. [SP=9.5 Cap=16m]

◄Quadrise (QED)► AGM stmt - while progress in last 12 months has been slower than expected "time has been well spent". Shareholders will be hugely reassured by that. [SP=1.5 Cap=26m]

◄Tavistock Investments (TAVI)► buys Alpha Beta Partners, an asset management firm with nearly £3 billion in assets, for £6m plus £12m earn-out. [SP=3.55 Cap=20m]

◄National World (NWOR)► has rebuffed an approach at 21p, a 40% premium. "Media Concierge has made every effort to engage privately with National World and its advisers, but has had no substantive engagement to date."

In line: MBH, RTC, DFS

Stop Press: Mr Seamus (my 18 year old dog) survived his sedation and having a few teeth removed, and clippering. Medivet relieved us of… wait for it… £2,000 - no wonder there is a CMA investigation into the robber barons of the corporate acquirers of vet practices (With full respect to vets themselves, who are wonderful). He’s still feeling a bit groggy, but we’re told could make it to 20! :-)

Star share of the day - Games Workshop (GAW) - ahead of expectations update.

Good morning from Paul!

Daily podcast - I’ll record this a bit later this afternoon. Now done - these are going out as separate posts on Substack, and through the conventional podcast channels (eg. Apple, Spotify).

Here is our now usual weekly roundup live (and recorded) video with Paul Hill -

Hopefully the written report formatting is a bit better today, I’ve gone back to the old style that I invented for Stockopedia, of summaries at the top, and main sections below.

As previously mentioned, today is the day I’m turning on subscriptions. Hence for everyone who has pledged support, thank you firstly, and please expect Substack to contact you asking for whatever payment you’ve said you’re happy to give. I’m very grateful for the support for this project, it’s been a leap into the unknown, but so far is going really well! (Fab response from everyone today, thank you!!)

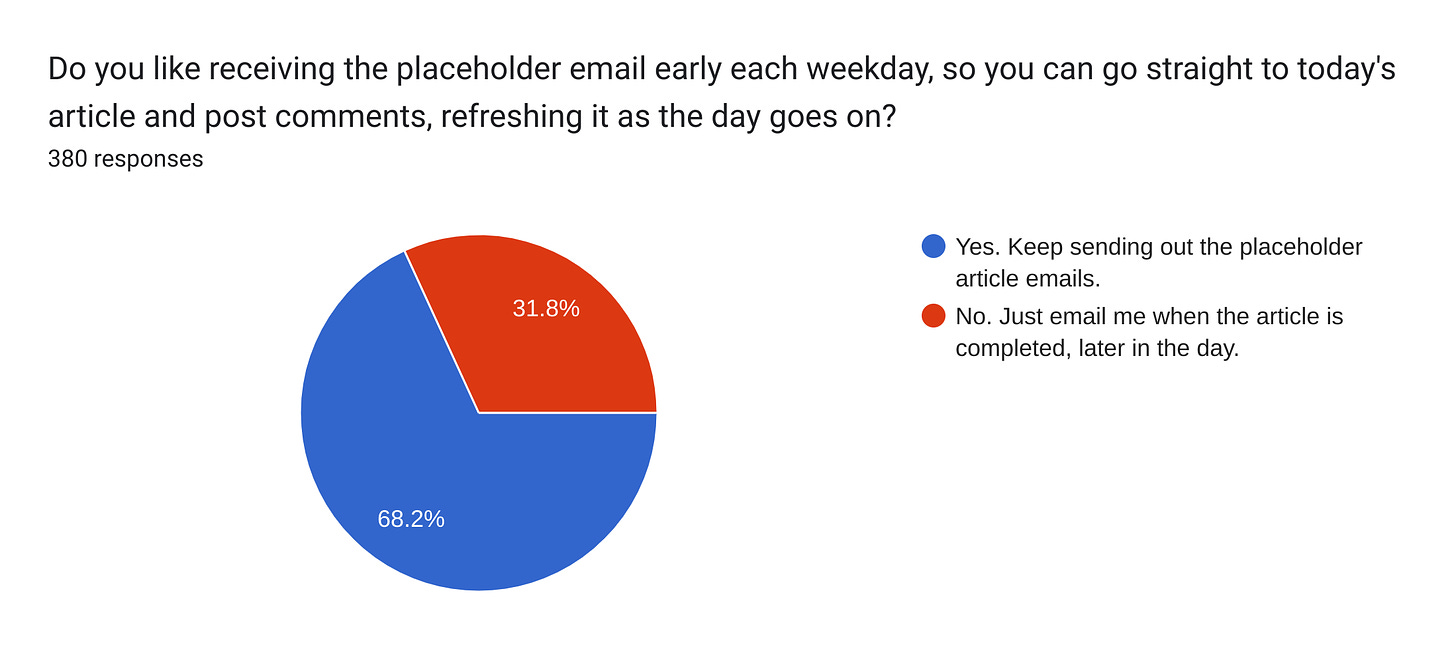

The result of yesterday’s survey was clear, thanks to everyone who responded, I know what the majority want now -

Let’s see what fresh horrors the 7am RNS delivers! I’m writing this at 06:50, just about to make a pot of strong coffee! Update: fairly quiet for news today so I’ve added a couple of items from yesterday to my initial list. As I write the main sections, this list will turn from a to do list, into a summary section. Let’s see if that works (I’m trying out various formatting ideas) -

DFS Furniture (DFS) - up 2% to 135p (£317m) - Trading Update (in line) - AMBER/RED

Quick comment only - FY 6/2025 update. Order intake is showing growth vs LY for first 20 wks, but no figures are provided, so it’s not likely to be strong growth! Trading in line with expectations. More cost-cutting done. Interim CFO joining shortly, after abrupt departure of previous CFO. Consensus forecast is only 7.2p FY 6/2025. Horrendous, dangerously over-geared balance sheet. High risk, but could do well in a cyclical recovery.

Michelmersh Bricks (MBH) - Trading Update (in line) - AMBER/GREEN

Quick comment only. “Resilient” trading for FY 12/2024. Building a “well balanced forward order book”. Overall it expects revenue, profit, and cash to be in line with expectations at Dec 2024 year end. Industry recovery in activity is uncertain in timing. Paul - nice secure balance sheet. Decent divis 4.7%. Looks well set up for an industry recovery, I like this.

RTC (RTC) - up 8% to 105p (£14m) - Trading Update (in line) - AMBER

Quick comment only - trading in line with expectations, and confident about FY 12/2024. “Economic conditions remain challenging”. Should benefit from UK infrastructure spending. All sounds quite upbeat. H1 results were good, defied sector gloom. Sound, ungeared bal sht. Overall not bad actually, but too small.

National World (NWOR) - up 23% to 18.5p (£49m) - Statement from Media Concierge Holdings - PINK (takeover)

25% shareholder MCH announces an indicative 21p cash bid approach, which NWOR mgt have refused to engage with. There’s some ambiguity over how much MCH’s concert party hold - is it 28%, or 72%? I’ve made enquiries to clarify this, the answer is definitely 28%. Apparently I was not the only journalist confused by this! NWOR has responded, revealing there is a serious dispute over invoicing & payments between the two companies. (Main section below)

Games Workshop (GAW) - up 10% (08:08) to 12,850p (£4.25bn) - Trading Update (ahead exps) - GREEN

Licensing revenue has been particularly strong, delivering a bumper H1. Expect forecasts to rise. I don’t know how to value this share, but it’s a unique company. (Main section below)

From yesterday -

FW Thorpe (TFW) - down 14% last 2 days to 308p (£360m) - AGM Trading Update - GREEN

Quick comment only . FY 6/2025 update. H1 so far seen orders & revenue “modestly ahead” of LY (last year). H1 profit expected “marginally ahead” of LY. Divisional performance mixed. No broker forecasts. Last year it did £30m PBT, which I would adjust up to £33m, as they don’t remove goodwill amortisation & similar. So I make that about 23p adj EPS likely for FY 6/2025, a PER of 13.4x. Factor in the fabulous balance sheet too, and this thing is looking cheap, for a good quality business (high margins). It’s a GREEN from me. Has it gone ex-growth though? Seems very illiquid, and in a downtrend.

Paypoint (PAY) - down 5% last 2 days to 795p (£570m) - H1 Results - AMBER

In line results & outlook seem OK. It’s using cashflows from the legacy business to pay divis, do buybacks, and make acquisitions. The result seems a bit of a scattergun approach. It was cheap earlier this year at 500p, but at 800p the price strikes me as up with events. Although if targeted growth in EBITDA is achieved, then there could be further upside, who knows?

Main Sections:

Paypoint (PAY)

Down 5% last 2 days to 795p (£570m) - H1 Results - AMBER

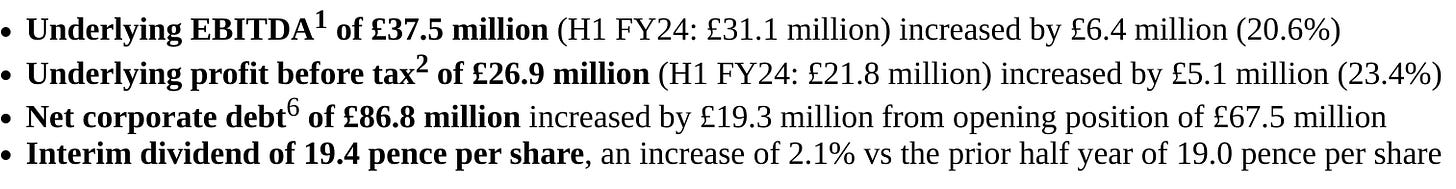

Highlights look strong, although the increased debt implies it’s possibly bought in some of the growth with acquisitions? -

The segmental analysis shows 2 divisions - with H1 PBT split -

Paypoint £24.6m (up 4%)

Love2Shop £2.3m (improved from a £(1.8)m loss in H1 LY)

So still very much focused on the core business, but a turnaround underway at the voucher business Love2Shop, acquired a year or two ago.

It strikes me that PAY is trying out lots of new ideas, with various other activities in payments, open banking, all making it rather difficult to assess what the future holds. It seems a cash-generative core business, which is funding a range of other activities, without it currently being clear how successful any of the new things are likely to be.

Outlook - it’s talking about a target of £100m pa EBITDA by FY 3/2026, which seems a good bit higher than existing forecasts. Maybe it means a monthly run rate? H1 2025 EBITDA was £37.5m, so £75m annualised currently (assuming no seasonality).

Overall outlook is in line -

“We remain confident in delivering further progress in the current year, meeting expectations and achieving our medium-term financial goals.”

Dividends are generous, and it’s also doing share buybacks.

Balance sheet - I do not like. If I treat investments are intangibles, then it has negative NTAV of c.£(100)m. Overall the balance sheet strikes me as large, and complicated, and I’m put off a bit by that.

Paul’s opinion - PAY shares have had a great run this year. I was much more positive when it was obviously cheap at c.500p in early 2024. Now it’s c.800p the value metrics don’t look so good, and most of the profit does come from a legacy business remember, that might slowly decline.

I just can’t get excited about this, so for me it’s an AMBER.

National World (NWOR)

Up 23% to 18.5p (£49m) - Statement from Media Concierge Holdings - PINK (takeover)

I’ve edited this section, as the ambiguous wording initially misdirected me.

A company called Media Concierge Holdings (“MCH”) has issued this statement, saying it has approached NWOR with a possible offer of 21p in cash (40% premium).

MCH says its concert party already owns 28% - update I have clarified this by speaking to MCH’s advisers. My apologies for me initially getting this point wrong.

I’ve had a look through MCH’s accounts at Companies House (no. 02972740). It’s controlled by M C Denmark. It reported £113m revenues for FY 9/2023, and made £9.1m PBT, so this is a credible business in the same sector (newspapers & marketing). Therefore this looks a serious bid approach.

MCH is asking for NWOR management to roll over and recommend the deal, and that it wants to do some light due diligence.

Paul’s opinion - no strong view either way really. NWOR is a cigar butt type share, consolidating what’s left of regional newspapers, etc. Now it looks as if it might be consolidated by MCH.

It will be interesting to see how NWOR respond.

Takeover multiples in this sector are understandably very low, so I think a 21p exit would be a good outcome for NWOR shareholders. The investment case was always that it might be worth a bit more than its bombed out valuation, but not a lot more. That’s what’s on the table here, so I’d be inclined to accept this deal if I held.

UPDATE - Response from NWOR - Statement re possible offer - says it has considered the possible offer with its advisers, and “acknowledges the potential merits of the Possible Offer.”

However, there appears to be a serious dispute between the companies -

“On 1 October 2024, prior to the approach by Media Concierge, the Company was made aware of a potentially systemic pattern of historical invoicing irregularities in relation to the activities of entities affiliated with Media Concierge. The Company commenced an investigation of these matters on 2 October 2024 (the "Investigation").

In addition, entities affiliated with Media Concierge are currently inappropriately withholding revenues due to the Company totaling £4.4 million.”

NWOR confirms it has £10.9m in cash, despite MCH-related parties withholding £4.4m.

Paul’s updated view - that sounds like a no, for the bid approach, or at least that NWOR wants to get the disputed invoicing issue resolved first. I wonder if this could be a situation where selling half in the market might be a sensible option for small shareholders, to be on the safe side? Your money, your call!

Games Workshop (GAW)

Up 10% (08:08) to 12,850p (£4.25bn) - Trading Update (ahead exps) - GREEN

This retailer of wargaming figurines has been a remarkable success over the many years I’ve followed it. Which always begs the question, why don’t I own any shares myself? Well, I did - but decided they had become too expensive once they went over £10/share in 2017, and sold them! It’s 13-bagged since then. So if they sell a figurine of a muppet, I should probably buy it, paint it with a red face, and call it Paul!

I last looked at GAW on 19/6/2024, briefly commenting - “Games Workshop GAW £3.1bn. Rose 7% on TU, not clear if in line or ahead. Divi yield 4.6%. Not enough info to make a firm view, but looks good to me.”

Today’s update - it has a 5/2025 year end, so today gives some figures for H1 to 11/2024 (I disregard the one day slippage into 1/12/2024) -

“The Group is pleased to announce that trading since the last update on 18 September 2024 is ahead of expectations. The Board's estimate of the results for the six months to 1 December 2024, at actual rates, is core revenue of not less than £260 million (2023/24: £235.6 million) and licensing revenue of not less than £30 million (2023/24: £13.0 million). The Group's profit before tax ("PBT") is estimated to be not less than £120 million (2023/24: £96.1 million).”

That’s a remarkable 25% rise in PBT vs LY. Note that’s mainly driven by a 131% increase in licensing revenues (which are very high margin). So the key question is whether licensing revenues are on a big growth trajectory, or if there’s any element of one-off in the above growth? That’s key to valuing this share I think. Edison’s note assumed lower licensing revenues this year, after a record FY 5/2024, flagging the “lack of visibility”, but high profitability of licensing revenues. So it seems to be a tricky share to forecast accurately.

The only broker research available to me is from Edison, from 7/10/2024, estimating £198m PBT for FY 5/2025. Hence it achieving £120m+ in H1 alone, suggests forecast profit are likely to be raised.

Checking the seasonality in previous years shows an H1 bias to profits for 3 years, switching to an H2 bias in the most recent 2 years, so I’m not sure whether we should expect H2 to be higher or lower than the bumper £120m H1?

Broker consensus on Stockopedia shows only flat (vs LY) EPS of 474p for FY 5/2025, so with this barn-storming H1 (driven by licensing), should see forecasts raised to, at a guess, 500p+? At 12,850p that gives a PER of c.26x. I’ve already demonstrated the folly of selling great companies because their shares look too expensive, but there still has to be a limit at some level. Growth from the core business looks quite good, but it’s the licensing that’s looking more interesting, so I can’t judge if the shares are good value or not, without more information on future likely licensing streams.

Free cashflow is highly impressive - as essentially an IP company, GAW throws off cash, and pays most of it out in divis. The forecast yield is about 3.7%. The last balance sheet is fine, they’re keeping back enough cash to make it securely financed.

Paul’s opinion - how could I not be GREEN?! This company is unique. I don’t really know how to value it though, because I don’t know enough about the likely future direction of licensing in particular. The customers seem very sticky, even obsessive about this hobby, which enables GAW to make spectacular profits & margins, and I imagine that’s not likely to change any time soon. So maybe it’s a buy & hold forever type of share?

Have been mulling over my (reduced) holding in CARD Card Factory, impacts of the headwinds (increases in NIC, business rates and min wage) and how much these are already in the price - halved in a couple of months)

I mystery-shopped their High Holborn branch yesterday - the interior was immaculate, with all shelves/walls covered in neatly, fully packed, colourful products.

I was concerned it was literally empty but was told they have a manic rush before work and then it resumes around 11.30am.

The manager Tracy explained each store has a different customer/sales profile - this being office driven with customers encouraged to add a couple of balloons to a large card to create low-cost team occasions.

While there had been challenging times during covid staff thought the company had managed this well and fairly and longer-term, committed employees like her had remained with the business when normality returned.

She was an excellent ambassador for the company, readily understood their challenges but also “where the business was” and other team members seemed to have a shared sense of purpose.

If all shops were run like this it would be reassuring.

Live today at 3pm (22nd Nov) on VOX Markets, Paul & I will be chatting again about all things smallcap.

Everyone is welcome of course, & you can ask questions too.

https://www.youtube.com/watch?v=yDIOSFM7gos