Fri 24 Jan 2025 - Paul Scott's Small/Mid Cap Value Report

Free: SXS, MTO, THG, MAB1, ANCR, NET, REVB, AGL, SKL, QED, PULS, ZOO, WRKS, BMY Premium: BRBY, RNWH, ASLI, REC

MrC's Smallcap Sweep: Mealy-mouthed warning from Tasty

TAST, TMIP, ASLI, BMY, RGBP, IQE, REC, PULS, ITM, WRKS

◄Tasty (TAST)► after a gloomy preamble it guides FY-Dec rev £36.6m 'from the restructured estate' and adj EBITDA of £3.8m (£4.4m). Is that a miss then? Do tell. Stockopedia has FY24E £38.9m. "Closures of part of the Group's estate has had a negative impact on sales and has precipitated some significant operational adjustments." Is that some surprise to them? Outlook "confident of being able to overcome the current challenges but remains cautious in the current climate". [SP=1 Cap=2m]

◄Taylor Maritime Investments (TMIP)► end-Dec NAV $1.28/sh down 20c in 3 months. Blames softer asset values. Special dividend of 4c following recent vessel sales at close to NAV. [SP=74.6 Cap=310m]

◄abrdn European Logistics Income (ASLI)► wind-down taking longer than hoped but has sold 3 assets (RNS 28 Nov) for €45.4m. One The Netherlands in latest available valuation and two in SPain at 12% ahead. Expects initial return of capital in Q1 2025. I hold. [SP=56.4 Cap=233m]

◄Bloomsbury Publishing (BMY)► has reached a new long term supply agreement with Amazon. Trading in line with FY-Feb F/C of rev £334m and adj pretax £39.6m. [SP=654 Cap=534m]

◄RBG Holdings (RGBP)► one week extension of exclusivity period with Mr Rosenblatt for talks on the sale of the 'Rosenblatt' branded business. [SP=NA Cap=NA]

◄IQE (IQE)► has strengthened its partnership with Quintessent to establish the world's first large-scale quantum dot laser (QDL) and semiconductor optical amplifier epitaxial wafer supply chain. Now that's the kind of jargon I like. It will be usd for improved optical data links. "IQE and Quintessent have collaborated for over a decade to transition QDL technology from research to large-scale production." [SP=13.2 Cap=128m]

◄Record (REC)► guides FY-Mar fee income in line and rev slightly ahead of expectations. [SP=47.5 Cap=95m]

◄Pulsar (PULS)► guides FY-Nov rev £62m. Adj EBITDA c. £9m up 23%, in line. Rev miss then? [SP=56 Cap=70m]

◄ITM Power (ITM)► wins contract from a European energy company to jointly develop a standard design configuration for a 10MW green hydrogen production plant. This "further cements NEPTUNE V as the clear leader in its class". [SP=34.15 Cap=211m]

In line: WRKS

Good morning from Paul!

GfK’s widely followed consumer confidence monthly figures are out today. I hope they don’t mind me showing the table below from their press release here -

The overall score at the top has dipped sharply from -17 in Dec 2024, to -22 in Jan 2025. This is hardly surprising, given how we’re assaulted with a daily barrage of negativity from the media. And to be fair, the economy is only slightly more than flat-lining (GDP), and we’ve had a fair bit of damage done by unqualified, inexperienced and clumsy new politicians taking the reins in the last 6 months. Not really a time to be learning on the job, but that’s where we are.

I’ve highlighted one line above which gives me considerable comfort, that people are roughly in balance in how they see their personal financial situation developing in the next 12 months. Given that I suspect people who reply to surveys might often say what they think they’re expected to say - ie. to be unremittingly negative, then it’s rather pleasant to see people in balance positive/negative about the outlook for their own personal finances. That suggests to me that consumers may actually be more confident than the headline numbers reflect. But then I’m a natural optimist, so will usually see the glass half full!

Warm welcomes

Thank you to the many people upgrading to premium, it’s wonderful to receive your support. Today we have new members -

Pete, GeorgeZ, SimonH, Euan, AnthonyH, deeH, Shellis, AlanP, RichardL, TimR, PeterD (founder member!), AndrewP, MikeA, StephenJ (from New Zealand!), BenA, Brian, JosephM, Laurie, WayneD, Hannah, HarryF, Simon, AdamC, and Leigh.

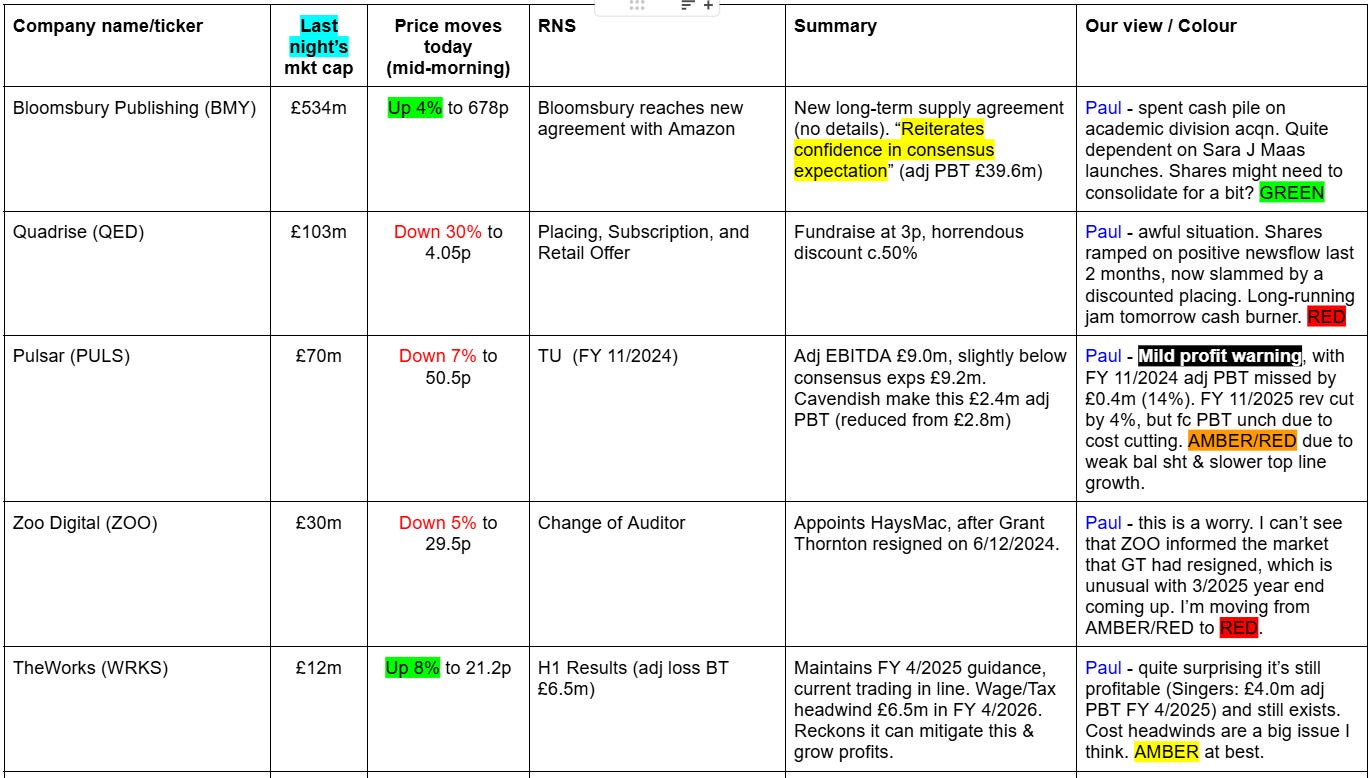

Phew, what a busy week! I neglected free members yesterday, so guilt got me out of bed at 5am today, and I’ve now covered most of yesterday’s gaps, here’s the updated free list (below) - some potentially interesting shares here for you to investigate in more detail - please remember my stuff is only quick reviews, you have to do much more in depth research yourselves, due to the huge number of companies I look at only allowing a modest amount of time for each -

On to today’s news (Friday), thin pickings in the free section I’m afraid -

End of free section.

Keep reading with a 7-day free trial

Subscribe to Small/Mid Caps with Paul Scott to keep reading this post and get 7 days of free access to the full post archives.