Mon 16 Dec 2024 - Paul Scott's Small/Mid Cap Value Report

Free: VID, CAN, OBD, XLM Premium: FTC, TSTL, SAGA

MrC's Smallcap Sweep: You TERN if you want to...

SAGA, RCDO, OBD, GPL, TERN, VID, XLM, TSTL, TON, QED, FTC, SEEN, GLB, AEWU, CNC, BOOT, CRTA

◄Saga (SAGA)► as mooted, agrees to establish a 20-year partnership for motor and home insurance with Ageas. CEO chirrups "Together, we represent a winning combination...from which we can serve even more customers with relevant, innovative and intuitive products". I just want my car insured mate, not an engine calibration computer. I hold. [SP=123.6 Cap=177m]

◄Ricardo (RCDO)► sells defence division for $85m = £67.5m (as adjusted post-Closing on a cash-free, debt-free basis). Also buys 85% of E3 Advisory for AUD $101.4m = £51m. The sale will be EPS dilutive in the near term, partly offset by earnings from E3 Advisory. Ricardo remains confident of doubling operating profit on an organic basis but now later than 2027. [SP=402 Cap=250m]

◄Oxford BioDynamics (OBD)► CEO scarpers. He is thanked. Co continues to explore funding options, particularly a potential equity fundraise of £4m. [SP=1.2 Cap=4m]

◄Graft Polymer (GPL)► to buy Awakn Life Sciences Corp, valued at approximately £4.98m, for c. 2 beeeellion shares. [SP=0.24 Cap=5m]

◄Tern (TERN)► £400k placing at 1.3p, a 16% discount, to keep the lights on. [SP=1.52 Cap=8m]

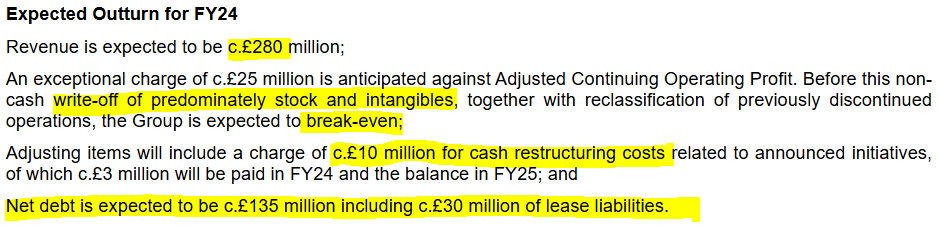

◄Videndum (VID)► warns FY-Dec rev only c.£280m as recovery in its markets continues to be slower than expected. Expects c.£25m write-down of stock and intangibles. Also £10m charge for cash restructuring costs: c.£3m in FY24 and the balance in FY25. [SP=260 Cap=245m]

◄XLMedia (XLM)► the cash shell plans tender offer of up to £16m, about half its cap. Guides ear-out proceeds of $3-4m and possibly up to $5m. [SP=12.5 Cap=33m]

◄Tristel (TSTL)► AGM stmt: co "expects to hit, if not exceed, it's [sic] three-year target of 10% - 15% revenue growth by 30 June 2025. The business continues to grow, and we continue to trade in line with expectations". So guiding a future beat then? [SP=390 Cap=186m]

◄Titon (TON)► completes disposal of S. Korean ops. Also will make a £1.3m stock write-off. [SP=76.7 Cap=9m]

◄Quadrise (QED)► signs Material Transfer and Trial Agreement with Sparkle Power for a power generation trial. [SP=4.13 Cap=71m]

◄Filtronic (FTC)► serves yet another beat - "demand remains robust with the second half benefitting from pull-forward of customer orders". [SP=72.75 Cap=158m]

◄SEEEN (SEEN)► issues £325k of convertibles with an option for £487k more. [SP=3.97 Cap=5m]

◄Glanbia (GLB)► another buy-back, £50m max. [SP=13.77 Cap=3682m]

◄AEW UK REIT (AEWU)► part sale of retail warehousing park for 7% above book. I hold. [SP=101 Cap=160m]

◄Concurrent Technologies (CNC)► wins $3.33m order for H1 2025 delivery. [SP=136 Cap=117m]

◄Henry Boot (BOOT)►enters JV for a UK-based industrial and logistics platform named Origin, backed by a £100m development portfolio. [SP=NA Cap=NA]

◄Cirata (CRTA)► wins c.$2m one year Live Data Migrator contract. Co withdraws its FY24 bookings guidance "partly due to certain major customers opting for one-year terms rather than multi-year terms and some movement of pipeline opportunities and bookings expectations from Q4FY24 to H1FY25". CEO body-slams old mgmt "I thank our colleagues for getting us towards the end of the recovery phase of the Company. We inherited a broken business from a peak annualized cost base of $45m per annum to a company exiting FY24 with a cash overhead of circa $20m". [SP=24.66 Cap=31m]

Good morning from Paul! As always, my grateful thanks to Alun for posting his snapshot here - how does he cover so much ground in under an hour?!

That’s covered pretty much everything of interest today, so I’ll sign off.

Videndum (VID)

Down 18% to 210p (at 12:00) £198m - Trading Update [profit warning] - BLACK / RED

“Videndum plc ("the Company" or "the Group"), the international provider of premium branded hardware products and software solutions to the content creation market, issues the following pre-close trading update for the year ending 31 December 2024.”

I haven’t looked at VID for a while, but my former colleague Graham Neary marked it RED on 26/9/2024, with slower than expected demand, and worries over going concern. I nearly always agree with Graham, so am happy to rely on his view.

VID shares have been a disaster since the peak in 2021-2, losing >80% of their value.

Note also the share count has roughly doubled, after a substantial equity raise in H2 of 2023.

Today’s news -

Slower than expected recovery.

“Some signs of gradual improvement, which we believe will benefit trading in H1 2025”.

Self-help measures to improve efficiency & increased cost savings.

Merging from 3 divisions into 2.

Cost-savings: 80% of £10m savings plan implemented, no benefit to 2024, will benefit 2025.

Revised guidance looks grim - another big down day for the shares seems likely (writing this as 07:52) -

For comparison, it made £6.9m adj PBT in H1 (but £(10.8)m statutory loss before tax). So today’s statement implies a trading loss in H2 on an adjusted basis, and a large statutory loss.

Net bank debt of £105m looks alarmingly high, despite the equity raise last year.

I see the CEO jumped ship or was sacked on 28/10/2024, usually a warning sign that things are not going well.

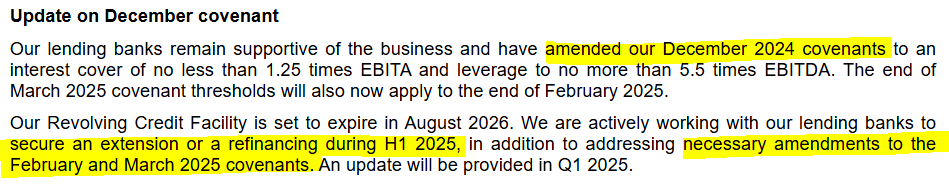

Bank borrowings - clearly a problem (as Graham correctly identified previously) -

Paul’s opinion - I haven’t got much choice than to run with Graham’s RED. It’s too risky for now, and it’s clear that VID was not well managed under old management. Although new management would say that, to deflect blame.

I can’t see any appeal to this share, and will be steering well clear, until the next placing is under its belt. I don’t mind investing in companies that are struggling in the short term, but not if they’re breaching, or seeking waivers for bank covenants. In that case, a very cheap share price is necessary to make risk:reward attractive, and it’s difficult to see any appeal at VID whilst valued at £241m market cap (EDIT at 12:03 - now £198m).

At some point trading might improve, but I don’t have any insights as to when, and how much this might occur. So why would I want to gamble on recovery here?

Canal+ (CAN)

A new listing in London today, with its 992m shares currently trading at 241p (at 10:26) that’s a hefty market cap of £2.39bn. Let’s hope this float goes well, as we need to the IPO market to recover. Prospectus is here.

This is a French media company, spun off from Vivendi in a “partial demerger” with Bollore Group retaining 31% of CAN. The rationale is that Vivendi was suffering a “conglomerate discount” where dismantling it would create a greater sum of the parts.

I’ve had a quick skim of the prospectus, but didn’t see anything of any interest from my perspective. Given the disastrous crop of IPOs we’ve had in recent years - many being over-priced and/or junk, often cynically floated to maximise valuation for the vendors on a temporary surge in profits, I have zero confidence in the city to launch attractive new issues - they’ve killed the golden goose chasing lucrative fees. Hence I won’t be investing in any IPOs for the foreseeable future, and will want 2+ years track record as a listed company before even considering any purchases.

Oxford Biodynamics (OBD)

Down 24% to 0.91p (£3m) - CEO Resigns, Funding Update - RED

“Oxford BioDynamics, Plc (AIM: OBD, the Company), a precision clinical diagnostics company bringing specific and sensitive tests to the practice of medicine based on its EpiSwitch® 3D genomics platform…”

CEO resigns with immediate effect.

Iain Ross joins with immediate effect, as Exec Chairman designate, subject to completing an equity fundraise.

Funding - to be fair, OBD has been indicating for some time that it would run out of cash in early 2025. Indeed on 17/1/2024 (26p share price) I flagged here (Stockopedia) that it was burning through cash at a prodigious rate, and would need to come back for more cash.

Paul’s opinion - obviously remains at RED. It’s in the unheated external porch of the last chance saloon. It now all depends on whether existing shareholders are prepared to fund yet another equity raise. Even if they do, the terms could be crushing for existing equity. All too often we see this scenario of losses, disappointments, repeated fundraises at lower & lower prices playing out on AIM. It’s just best to avoid everything that has any funding uncertainty I think. Buying stuff like this used to be a the biggest drain on my portfolio performance. Holders need to pray for a miracle.

XL Media (XLM)

Down 23% to 9.5p (£25m) - Update on distribution of capital - AMBER

“XLMedia (AIM: XLM), a sports and gaming digital media company is providing an update on its plans for an initial distribution to shareholders from the proceeds of the assets sales related to the Europe Disposal and the North America Disposal (together, the "Disposals").”

XLM has sold off its operating businesses, and is now a cash shell. It does not intend making any acquisitions.

It intends doing a tender offer (price not stated) of up to £16m in 2025.

More cash receipts are expected, and hoped-for (earn-outs) in 2025, but the sting in the tail is this bit - big shutdown costs -

“The Group estimates its costs to clear liabilities including deferred minimum guarantee payments, settle tax in each jurisdiction in which it operates, support the transitional service agreements and close down the Group, including redundancy payments to be in the order of $11 million to $13 million.”

Paul’s opinion - the bull case has gone out of the window, in that people hoped the cash return would be usefully more than the market cap. That doesn’t look likely now, with the $11-13m shutdown costs looking far higher than I would have imagined.

Free section ends here (I’ll add a couple more items above the line as the morning progresses).

Keep reading with a 7-day free trial

Subscribe to Small/Mid Caps with Paul Scott to keep reading this post and get 7 days of free access to the full post archives.