Thu 27 Feb 2025 - Paul Scott's Small/Mid Cap Value Report

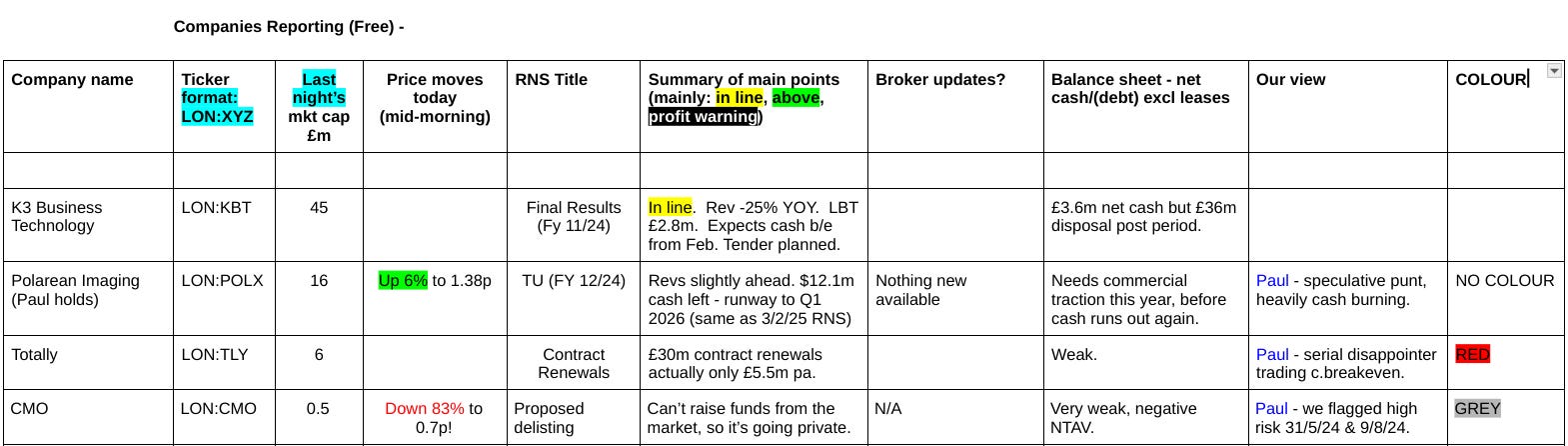

Free: TIME (briefs: POLX, TLY, CMO) Premium: CVSG, GNS, (briefs: RR, WPP, HWDN, OCDO, MTRO, ASLI, MACF, WKS, ITIM)

Liked by Small/Mid Caps with Paul Scott

MrC's Smallcap Sweep: Blame ducks

CMO, VRS, MPL, MACF, TMO, FAB, POLX, ASLI, ITIM, HVO, TLY, IXI, WIL, BRK, KBT

◄CMO (CMO)► another day, another delisting proposed. Claims there is no route to source additional funds while on AIM. Cost savings. It's only been listed three and a half years. [SP=4.27 Cap=3m]

◄Versarien (VRS)► repayment start of the 2020 £5m Innovate UK Loan delayed again to August 2026. This follows the IUK's review of progress and the potential benefits of Versarien's tech. How easily that graphene wool slides over the eyes. Interest payments have been rolled over, as has IUK, [SP=0.03 Cap=1m]

◄Mercantile Ports & Logistics (MPL)► sinks holders' hopes again as it warns F24 rev only £4.6m. Blames Maharashtra State election causing delay in contracts and very long loan refinancing renegotiations. [SP=0.97 Cap=3m]

◄Macfarlane (MACF)► FY24. Co sees continued difficulties in 2025, particularly from rising employment costs and regulatory changes, but remains optimistic about growth driven by new business opportunities and ongoing strategic initiatives. [SP=106.25 Cap=170m]

◄Time Out (TMO)► signs lease to open a new Time Out Market at New York City's Union Square, expected Autumn. [SP=40 Cap=143m]

◄Fusion Antibodies (FAB)► wins $250k contract for a new stable Cell Line Development project. [SP=8.4 Cap=8m]

◄Polarean Imaging (POLX)► guides FY-Dec rev $3-3.1m cf $2.5-3m guided before. CEO claims "Our pipeline is now building nicely, including further expected de novo sales". I hold a fag-end [SP=1.3 Cap=16m]

◄abrdn European Logistics Income (ASLI)► the wind-down at last coughs up its first cash return: 4p via B Shares. Ex date is 5 Mar. I hold. [SP=60.4 Cap=249m]

◄itim (ITIM)► guides FY-Dec rev up 11%. Pretax £175k compared to a market expectation of a £700k loss.5 yr contract extension with toy retailer The Entertainer with a new base subscription increase of more than 30%. [SP=41.5 Cap=13m]

◄hVIVO (HVO)► buys Cryostore, a bio-storage supplier, for £3.2m max. Earnings enhancing. [SP=15.9 Cap=108m]

◄Totally (TLY)► two contract renewals worth c. £30m. [SP=3.3 Cap=6m]

◄IXICO (IXI)► wins two contracts woth over £0.5m which will be recognised within a year, and increases the proportion of expected revenues for FY25 now contracted. [SP=10.17 Cap=9m]

◄Wilmington (WIL)► £5m max buyback. [SP=343 Cap=309m]

In line: BRK, KBT

Good morning from Paul & Dave, ready to leap into action at 07:00.

Update at 14:10 - that’s it for today!

VAT - as mentioned in yesterday’s podcast, I’ll have to register for VAT shortly on my return from Malta. So unfortunately prices will have to go up by 20% when the VAT registration kicks in, obviously I don’t get a penny of that, it’s your contribution towards the increased defence budget, would be one way of looking at it.

So to avoid the VAT, if you want to upgrade to premium, then it will be £100 (no VAT) for a couple more weeks, then £120 (inc VAT) after that. Same with monthly subs, that will have to go up from £10 to £12 when VAT kicks in. So now’s the time to upgrade to a full year for £100, if you wish to side-step the VAT coming in. Sorry about this, but obviously I have to do what is required by the tax authorities.

Today’s postcard from wet & windy Malta - just like being at home!

First thoughts up by c.07:50. Running a bit late today due to the volume of announcements, we’re still ploughing through them at 08:21. Updated at 08:43 & 09:42

Time Finance (TIME)

Here’s an interesting intra-day situation for you! (so not in the list above)

Like a lot of smaller caps, TIME has recently gone into what seemed a self-reinforcing downtrend in recent weeks, as people banked profits (sensibly I would say) following a bull run that in my opinion took the shares up too high. It’s fine to disagree, it’s only one person’s opinion, which may turn out to be right or wrong, depending on how the future pans out.

Nifty work from the company today - it issued a positive trading update, which has put a stop to the selling, as you can see with today’s nice reversal (3-month chart with 15-minute bars below) from 47p to 52.5p - you can see the volume spike today too below -

(chart courtesy of ShareScope)

Today’s announcement was obviously rushed out, at 1pm - and wrongly titled “Notice of trading update”, when it actually IS a trading update! Here it is in full -

“Full-year results now expected to be ahead of market expectations

Time Finance plc, the AIM listed independent specialist finance provider, announces that it has continued to enjoy positive trading momentum throughout the first nine months of the 2024/25 financial year ("FY25") and confirms that the Company will provide its planned trading update in respect of Q3 FY25 on Tuesday 25 March 2025.

This positive momentum year-to-date includes record revenues, fifteen consecutive quarters of lending book growth, and arrears remaining well controlled. As a result, the Board is confident that Group performance for FY25 will be ahead of current market expectations1 which were previously raised in November 2024. Following continued strong performance, Revenue and Profit Before Tax for FY25 are now expected to not be less than £36.0m and £7.5m respectively.

1 FY2024/25 market expectations as at the date of this announcement of £35.1m of revenue and £7.2m of profit before tax.

So that’s about a 4% beat against forecast PBT.

Paul’s opinion - as mentioned before, I’m not interested in higher risk lenders, because I’ve seen lots of them unravel over the years, when arrears can suddenly balloon.

TIME management has done a good job of convincing investors that they’re making sustainable profits, and growing strongly. So far the figures seem to back that up, and an ahead of expectations update is a good way to stop the rot in terms of its shares selling off. I think there are better specialist lenders out there, which also pay divis, which TIME doesn’t.

End of free section.

Keep reading with a 7-day free trial

Subscribe to Small/Mid Caps with Paul Scott to keep reading this post and get 7 days of free access to the full post archives.