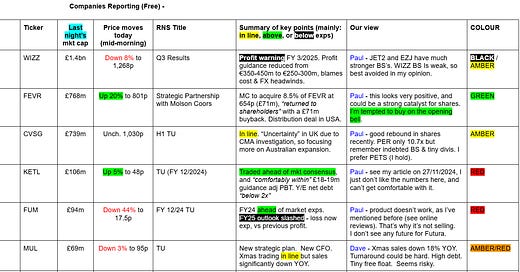

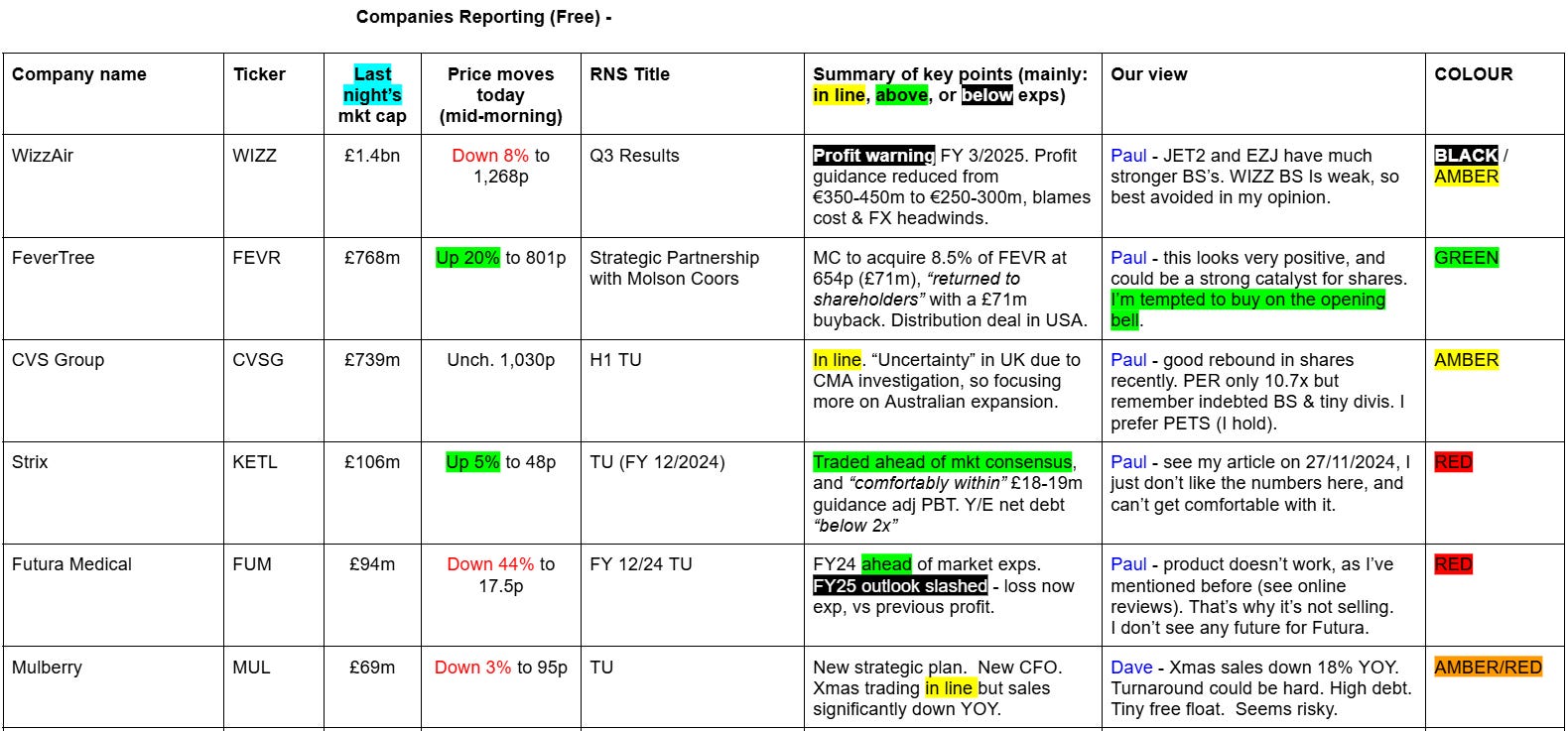

Thu 30 Jan 2025 - Paul Scott's Small/Mid Cap Value Report

Free: WIZZ, FEVR, CVSG, KETL, FUM, MUL, FLO, SPEC, NCYT, KMK, VNET, POLB, GUS, EAAS Premium: DSCV, BOWL, LSL, TET, TPFG, RCDO, SOM, SAGA, CAM, SIS, TRX, EMR

MrC's Smallcap Sweep: Mulberry clothes its strategy in pattern of BS. FUM foresees huge flop.

25 companies & longest ever report.

MUL, FUM, FLO, TRX, NCYT, NFX, SWG, LEND, POLB, GUS, ZIN, KETL, SPEC, SAGA, CAM, SIS, MRIT, KMK, EAAS, RCDO, PEG, MER, VNET, TPFG, SOM, INSE, FNTL, TET

◄Mulberry (MUL)► recent Q rev in line. Announces new strategy: "Back to the Mulberry Spirit" which it hopes will "restore Mulberry to profitability through simplification, brand realignment and enhanced customer connection." It will realign Mulberry's identity "as a British lifestyle brand and reinvigorating its cultural relevance". What? We can also look forwards to its "leveraging insights to deepen connections". What a load of guff. [SP=90 Cap=63m]

◄Futura Medical (FUM)► guides FY-Dec rev and pretax ahead of mkt exp. Rev was £13.7m (£3.1m). Warns FY25 rev only half of exp and is unlikely to meet the requirements for the sales-based milestone payments. Expects pretax loss instead of profit. Blames rate of consumer sales expansion slower than expected. "Whilst launches have been well executed and met with strong retailer commitment, there have been learnings which require marketing strategies to be optimised." [SP=12 Cap=36m]

◄Flowtech Fluidpower (FLO)► guides FY-Dec rev down 4%. U/L EBITDA broadly in line with market expectations. Market headwinds persisted throughout the year, [SP=68.2 Cap=43m]

◄Tissue Regenix (TRX)► guides FY-Dec rev up 8%. Adj EBITDA 'profit' above expectations. "This will mark the second full year of profitability." It's not profit! Puts not-for-profit German joint venture, GBM-V, up for sale. This update excludes revenues, profits or assets of GBM-V. [SP=58 Cap=42m]

◄Novacyt (NCYT)► guides FY-Dec rev £19.6m up 85%. No EBITDA or profit given. "We now have a firm foundation, including a strong revenue base on which we can build." [SP=54.26 Cap=44m]

◄Nuformix (NFX)► £169k placing at 0.0675p, a 25% discount, to keep the lights on. That match is burning near the fingers now. [SP=0.08 Cap=1m]

◄Shearwater (SWG)► extends FY from end Mar to June "o better align the Group's financial year with its customer procurement cycle". Expects adj EBITDA about the same. New LTIP options totally 5% of cap. [SP=33.2 Cap=8m]

◄Sancus Lending (LEND)► guides FY-Dec loans £238m up 18%. New business was £114m up 12%. Expects B/E.Majority shareholder, Somerston, committs up to £10m of junior funding. [SP=0.5 Cap=3m]

◄Poolbeg Pharma (POLB)► PUSU extended to 27 Feb. [SP=5.23 Cap=26m]

◄Gusbourne (GUS)► guides FY-Dec rev up 1% and adj EBITDA flat at c.£0.7m. Co still working with Lord Ashcroft and explore various strategic options for his shareholding. That's going on since July! [SP=36 Cap=23m]

◄Zinc Media (ZIN)► wins comission for a multi-million pound BBC prime time quiz show. [SP=61.55 Cap=15m]

◄Strix (KETL)► guides FY-Dec adj pretax ahead of market consensus and comfortably in announced range of £18m to £19m. [SP=49.8 Cap=117m]

◄Inspecs (SPEC)► guides FY-Dec rev down 1.5%. U/L EBITDA in line at £17.5m. 2025 has started wel. [SP=42 Cap=43m]

◄SAGA (SAGA)► refinances debt in full "materially enhancing the Group's liquidity position, significantly increase covenant headroom and provide funding certainty as the Group moves to execute its growth plans". Interest 675bps over SONIA which will reduce as the Group de-levers. [SP=118.8 Cap=169m]

◄Camellia (CAM)► guides FY-Dec trading market expectations. Adj losses £4-5m vs £7-9m previously. Cites "better than forecast results in Eastern Produce Kenya and in its Indian companies and increased interest income and foreign exchange benefits following the successful sale of BF&M". [SP=4888 Cap=135m]

◄Science in Sport (SIS)► guides FY-Dec head of current market expectations with rev down 18% and adj EBITDA £4.2m (£2m). Outlook - "expect the return to growth seen in FY24 H2 to continue in to FY25 together with the full effects of the cost savings made in FY24". [SP=25.4 Cap=59m]

◄Merit (MRIT)► proposes delisting. Usual reasons. [SP=23.85 Cap=6m]

◄Kromek (KMK)► wins $37.5m 4 year contract from Siemens. Now expects profit in FY25. Gets $25m this FY. [SP=7.4 Cap=46m]

◄eEnergy (EAAS)► guides FY-Dec rev £27.1m after record Q3-4. In line? Adj EBITDA £0.4m (-£3.6m restated). Has restated Exceptional charge of £5.5m for FY23. Outlook - significantly improved EBITDA and cash generation in FY25. [SP=4.74 Cap=18m]

◄Ricardo (RCDO)► warns FY25 miss due to delayed orders. [SP=295 Cap=184m]

◄Petards (PEG)► warns FY-Dec below its expectations with rev £12.1m and adj EBITDA c.£0.4m. Expects a better FY25. [SP= Cap=]

◄Mears (MER)► £18m max buyback. [SP= Cap=]

◄Vianet (VNET)► warns FY-Mar rev c.£15.7m and EBITA c.£3.6m. Blames "a different mix of orders and products and some delays in contract completions and pipeline conversion". [SP= Cap=]

In line: TPFG, SOM, INSE, FNTL, TET

Good morning from Paul & Dave!

Free section here -

End of free section.

Keep reading with a 7-day free trial

Subscribe to Small/Mid Caps with Paul Scott to keep reading this post and get 7 days of free access to the full post archives.