Tue 19 Nov 2024 - Paul Scott's Small/Mid Cap Value Report

Starters: ECOB Mains: AVON, BOY, GEN, RKW

MrC's Smallcap Sweep: Savour the city sewer

WBI, REVB, VCP, SBTX, ABDX, SRT, LLAI, NEXN, AVON, TRI, MUL, CML, FNX, G4M

◄Woodbois (WBI)► £1m subcription at 0.21p, a 30% discount, to keep the lights on. [SP=0.29 Cap=12m]

◄Revolution Beauty (REVB)► H1-Aug. Outlook sounds in line but is that lipstick on a pig? Material uncertainty going concern stmt. [SP=13.98 Cap=45m]

◄Victoria (VCP)► sells its Turkish ceramic tile manufacturer for €10m. Acquirer takes on €27m of debt. Made adj EBITDA of c. £0.9m last FY. [SP=53 Cap=60m]

◄SkinBioTherapeutics (SBTX)► finanlises commercial terms of its agreement with Croda. This has taken 5 years from the initial agreement! Financial expectations are confidential but co now expects to be C/F positive from FY2025. [SP=14 Cap=32m]

◄Abingdon Health (ABDX)► AGM stmt - "confident of solid progress for FY2025". [SP=7.95 Cap=15m]

◄SRT Marine Systems (SRT)► wins $9m order for a system upgrade from a Middle East sovereign Coast Guard. Will commence Dec. I hold. [SP=45 Cap=100m]

◄LungLife AI (LLAI)► update on its operational progress. [SP=8 Cap=7m]

◄Nexxen International (NEXN)► $50m max buy-back. [SP=303 Cap=609m]

◄Avon Technologies (AVON)► FY-Sept. Outlook - "potential to reach our medium-term operating profit margin and ROIC targets in 2026, a year earlier than expected. These would be delivered against a backdrop of revenue growth exceeding 5% per annum and continued strong cash generation." [SP=1310 Cap=398m]

◄Trifast (TRI)► in line [SP=78 Cap=106m]

◄Mulberry (MUL)► H1-Sep rev down 19% and pretax loss £15.7m (£12.8m). New CEO says "In response to current market conditions, we have taken decisive steps to streamline operations, improve margins, reduce working capital, and strengthen our cash position...our industry is facing a period of significant uncertainty...I am confident we are making the right moves to bring Mulberry back to profitability." [SP=118 Cap=83m]

◄CML Microsystems (CML)► H1-Sept. Outlook - rev in line but "if the current trading environment persists, it will become challenging to meet management's full year expectations for trading profitability". I hold. [SP=256 Cap=41m]

In line: FNX, G4M

That’s Alun’s morning sweep above - as voted for by a clear majority in our recent reader poll, to be copied into the top of the main articles.

Good morning from Paul! Mello Derby starts today, so I’ll be travelling up from London later today, once today’s report is done here.

Today’s podcast is kindly sponsored by GoodMoneyGuide - please leave a review for me!

Here’s yesterday’s full report. I wrote it in the evening, as I was sick overnight & during the day. Sorry for any inconvenience. Unfortunately this might be an occasional unavoidable occurrence whilst I’m just a one man band. The vast majority of the time though, I’m ready and eager to produce loads of content for you. But obviously I cannot guarantee 100% daily coverage at this stage. Once I’ve got a co-writer, then yes we will be able to guarantee a report every day. One step at a time.

As usual, I’ll write up this report in sections as the morning progresses.

Please feel free to add your own comments on the news below.

Paul’s list of priorities today

Higher priorities (price % moves c.10:00)

Avon Protection (AVON) - strong FY 9/2024 results - main section done, below. AMBER/GREEN (up 9%)

Bodycote (BOY) - in line TU. Shares look good value. (up 6%). Main section done below, GREEN.

Genuit (GEN) - mild profit warning, broadly in line with lower end mkt exps. Main section done below, AMBER.

Rockwood Strategic (RKS) - leading small caps fund, performing very well. Main section done below. GREEN.

Right, that’s all I have time for today, as I have to now travel to Mello Derby.

GB Group (GBG) - good H1 results, op profit +21%. FY outlook in line. Debt reduced a lot.

Lower priorities

Mulberry (MUL) - awful H1 results. (down 7%)

CML Microsystems - H1 profit down, despite acquisition. Strong bal sht though with plenty cash & property. (down 8%)

Gear4Music (G4M) - H1 results. FY outlook in line.

Fonix (FNX) - In line TU.

Calnex Solutions (CLX) - Poor H1 results, losses widen. Outlook in line, but mentions uncertainties. Cash pile falling.

Revolution Beauty (REVB) - no turnaround yet. Revs down 20%, matched by cost cuts, so b/even. Weak bal sht & still over-stocked.

Trifast (TRI) - H1 results, adj PBT up 10% to £5.0m. (up 5%)

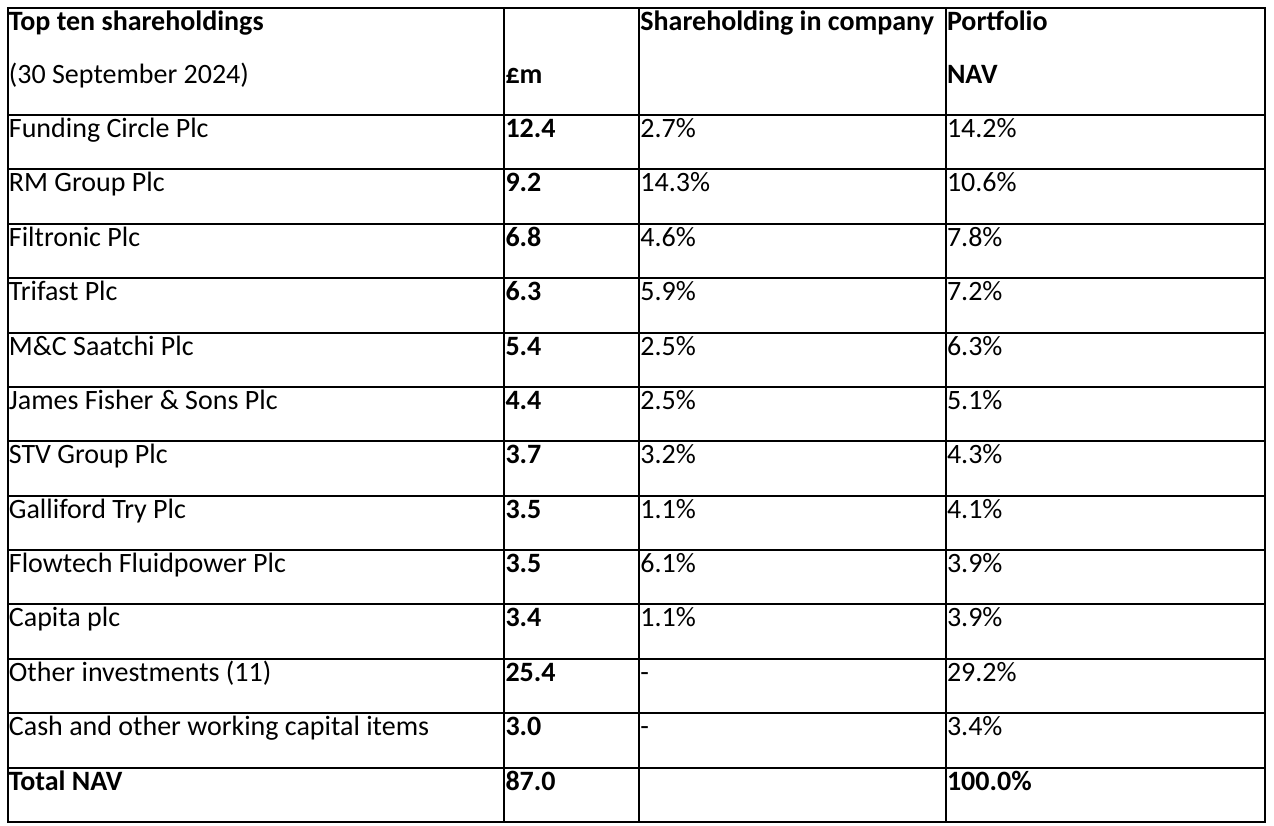

Rockwood Strategic (RKW)

Down 1% to 252p (£89m) - Interim Results - GREEN

I don’t cover investment trusts (ie. closed ended funds, so no redemptions to worry about), however Rockwood stands out because it’s part of the highly successful Harwood stable (which owns 23.5% of RKW), and is managed by the impressive Richard Staveley. Impressive in terms of getting results, not just because he sounds good. All fund managers sound good, but often their performance figures are lamentable. Not so here - Rockwood has thumbed its nose and blown a raspberry at the small caps bear market -

“NAV Total Return performance in the three years to 30th September 2024 of 48.5% which compares to declines in the FTSE AIM All Share Index of -40.5% and the FTSE Small Cap (ex-ITs) Index of -5.8%. The Total Shareholder Return in the same three-year period was 68.0%.”

I’d say Rockwood’s success is down to -

Great stock-picking,

Activism - intervening to help accelerate catalysts shareholder value,

Portfolio concentration, and inevitably

A bit of luck too.

It’s the no.1 UK domiciled small caps fund.

Encouraging words from Richard Staveley on how to generate outsized returns from UK small caps, which we can all learn from -

“Richard Staveley, Fund Manager, Harwood Capital, commented:

"There is much to distract the modern stock market investor and a 'wall of worry' appears to prevail. However, the UK has been one of the clear winners during the last 6 months; quietly, with limited fanfare, 'the wall' is being climbed. Stock-picking at Rockwood Strategic remains laser focused on the key drivers of our target returns: undervaluation, material self-help driven profit recovery potential and identifiable catalysts - accompanied by a good dose of patience and some constructive stakeholder engagement. It is paying off as we exceed our target returns and, currently, our relevant peers and indices."

Some other interesting snippets -

“a difficult AIM market is likely to create opportunities for our investment approach. Whilst the reduced incentives to invest in the AIM market cannot be viewed positively, the new government's post period end budget has at least delivered clarity over the tax outlook and did not, which the market was clearly worried about, remove AIM reliefs entirely…”

Actually, you might as well have a read of all the commentary, here it is.

For those of us who like to manage our own portfolios, here’s Rockwood’s top 10 (note there are no jam tomorrow story stocks in this lot) -

In the results statement there’s a paragraph on each individual position, explaining Rockwood’s rationale. Of course they don’t get everything right, nobody does, but the winners have greatly exceeded the losers. So I take careful note of all Rockwood positions, as they could be the turnarounds of the future.

Rockwood shares are trading at par with NAV, which seems attractive to me, as sometimes highly successful ITs go to a premium above NAV.

Genuit (GEN)

Up 1% to 424p (£1.05bn) - Trading Update (slight profit warning) - AMBER

“Genuit Group plc ("Genuit", the "Company" or the "Group"), the UK's largest provider of sustainable water, climate, and ventilation products for the built environment, today issues an update on trading for the ten months ended 31 October 2024. “

It talks about “subdued” market conditions, but is coping well by improving profit margin. That’s what I want to see from well-managed companies. The next step is hopefully then recovering demand, from a leaner cost base, and the operationally geared benefit of that. No sign of recovering demand yet though.

Is this a profit warning? Not really, as the existing range of forecasts is so narrow, that I think this is forgivable -

Market conditions are expected to remain subdued through the remainder of 2024 and into 2025. As a result, the Board expects full year underlying operating profit to be broadly in-line with the lower end of analyst expectations1

1 Genuit compiled analyst consensus forecasts for 2024 show Adjusted Operating Profit of £92m to £94m

Wages/NICs - headwind from budget is £5m in 2025, which it will try to mitigate.

Leverage - net debt expected to be 1.1x at year end, which is reasonable.

Balance sheet is dominated by £577m of goodwill & similar, so it’s clearly grown through multiple acquisitions. There’s only £50m NTAV, so personally I’d like them to hold fire on any more acquisitions - although it’s talking about doing more.

Paul’s opinion - if this might be the low point for earnings, then there could be upside from a cyclical recovery maybe in 2025 and beyond. This looks a good quality business, which makes a decent operating margin. Although I’m struck by the lacklustre share price performance, and only modest divis too in recent years. It probably wouldn’t be my first choice in the sector. Maybe management are addicted to doing deals, which don’t seem to create much shareholder value? I’ll go with AMBER for now. All the companies in the sector could re-rate though, once demand begins improving.

Bodycote (BOY)

Up 6% to 607p (£1.12bn) - Trading Statement - GREEN

“Bodycote, the world's leading provider of heat treatment and specialist thermal processing services, issues a trading update covering the four month period from 1 July to 31 October 2024 ("the period").”

Resilient performance in challenging end markets

This covers the bulk of FY 12/2024.

Revenue is slightly down YTD, but they finesse this by excluding energy surcharges, which produces adj revenues up 1% vs LY.

Most of the £60m share buyback has been completed, with c.£14m remaining to do. That’s brought about a useful reduction in share count from 191m to 184m. Shares look cheap, so I’d say they’re buying back at favourable prices.

Net debt is little changed during H2 to date, at £65.8m, which looks modest at roughly half its operating profit.

Outlook - sounds pretty good I think, given tough macro -

“Our end market environment remains mixed, with the challenging conditions in Automotive and Industrial Markets expected to continue into early 2025. Despite this backdrop, the resilience of our Specialist Technologies businesses and our ongoing focus on cost control gives us confidence in delivering good progress in operating margins for the full year (versus 15.9% delivered in FY 2023). Operating profit for FY 2024 is expected to be in line with market consensus.”

Very investor-friendly disclosure of analysts consensus from Bodycote’s website - why can’t all companies do this? -

So we’re looking at FY 12/2024 profits essentially flat vs 2023, and modest profit growth expected in 2025.

At 607p/share that gives PERs of 12.8x for 2024, and 11.7x for 2025.

Balance sheet - is surprisingly strong, with £403m NTAV, although this is dominated by £503m physical fixed assets, which includes £126m freehold property at end 2023. So this is a well capitalised business, which might attract bid interest from a financial buyer perhaps? Or maybe it’s too old school to get the financial engineers interested? Maybe a foreign trade buyer might be more likely?

Dividends - shareholders are getting a c.4.3% yield, on top of the buybacks.

Paul’s opinion - clearly a decent value share, so it has to be GREEN from me. Would I want to own this share forever? Not really, as it’s traded sideways for the last 10 years, between 500-1000p roughly. We’re fairly near the bottom of that range now, and shareholders have also received reliable divis over the years, including some specials.

So I think this looks good, as an unexciting but sound investment, that might re-rate, or get taken over. Even if it doesn’t, Bodycote looks a good quality business which is coping with slightly lower demand by increasing its operating margin. It’s GREEN from me.

Avon Protection (AVON)

Up 6% to 1,386p (£431m) - FY 9/2024 Results - AMBER/GREEN

“Avon Technologies plc make products that are trusted to protect the world's militaries and first responders.”

Adj EPS of 69.9 cents turns into 55 pence, so the PER is 25.2x - I don’t have a problem with high PERs, if the strong growth is expected to continue. So we’re being asked to pay up-front for about another 30% profit growth. That could be OK, as clearly something good is happening at AVON to produce the impressive profit growth below.

Adjustments are large, note the statutory PBT is only a negligible $2.3m for FY 9/2024, so that needs careful scrutiny. Here’s the breakdown. I wouldn’t want to see another year of adjustments on this scale -

Here’s the main table I was referring to above -

Operational KPIs caught my eye as being good. Although surely these are just some of the basics in running the business? So AVON must have been badly run previously -

Operating profit margin (adjusted) rose to 11.5% (8.7% last year), a good improvement.

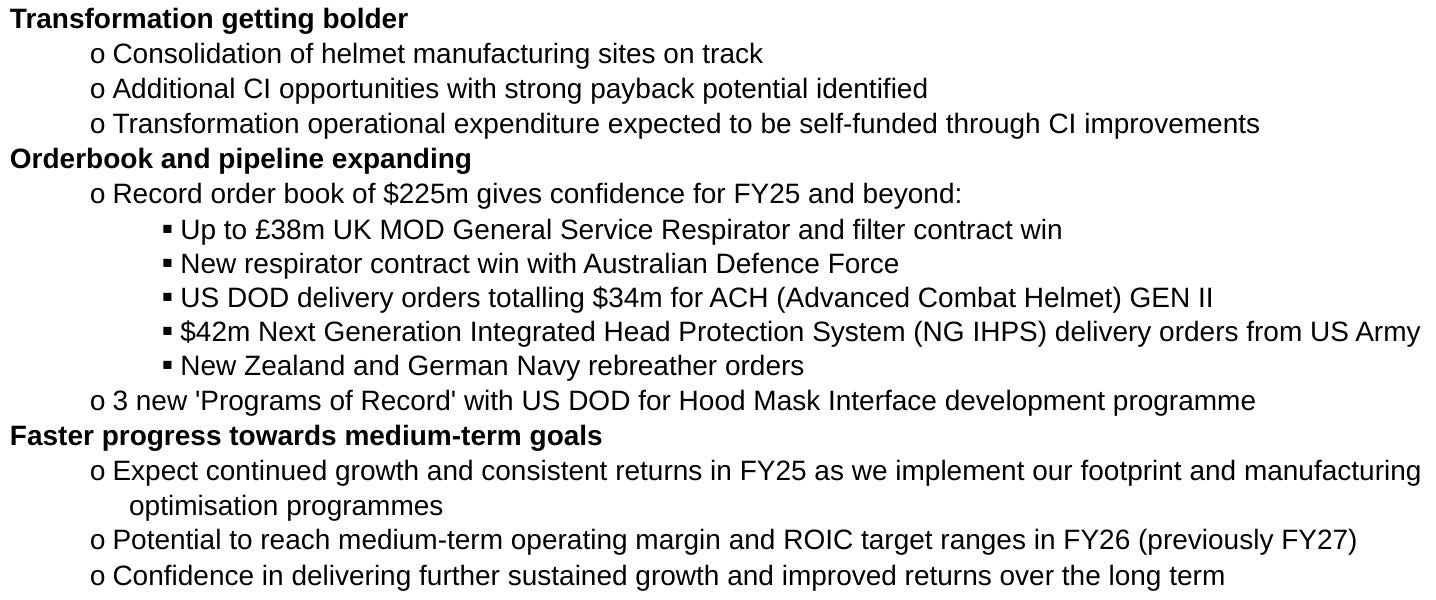

Forward looking comments all sound good to me - eg

I like that the big orders mentioned are from various different countries, so single client risk may not be too great (as we saw smash Solid State (SOLI) shares recently when the UK MoD paused some large orders).

Segmental performance shows that the core business is much more profitable than Team Wendy division, which is in a turnaround. That could be a good catalyst for further profit margin improvements, as it’s planning to consolidate into fewer manufacturing sites.

Net debt has come down nicely from $63.5m to $43.5m (1x EBITDA), which is much more comfortable now.

Balance sheet looks adequate to me. NAV of $167m becomes NTAV of $41m due to large intangible assets, which I always write off.

Receivables came down a lot, but I suspect that might be a one-off timing benefit, as they now look quite low.

Note the pension deficit, which has shrunk, but is still something needing careful investigation. The cashflow statement shows that a hefty $9.1m was paid into the pension scheme in FY 92/2024. Remember that deficit repair payments are real cash going out of the business, and it’s NOT included as a cost in the P&L. That’s over a third of adj PBT consumed by the pension scheme.

Cashflow statement - is very good, but I think boosted by an unusual fall in receivables. It’s hardly capitalised any development spending in FY 9/2024 (only $0.6m vs $3.6m LY), so that’s good to see. Cashflow statements reveal the cash that’s been hived off to buy shares in the market, to be given away to management in future. This can often exceed the P&L shares based payment charge. In this case, it’s $5.0m spent buying shares, not for cancellation, but for management, called “Long Term Incentive Plan”. This seems a lot, considering shareholders only got $6.8m in dividends. Maybe something to query on a webinar? Presumably there will be vesting conditions, hopefully challenging.

Paul’s opinion - as usual my articles are just quick reviews of the numbers. The clever bit is done by you - really digging into the business model and assessing its prospects. My impression of the figures, and in particular the upbeat commentary, is making me feel positive about this share. 25x PER is a punchy rating, but it could be justified here.

I might push the boat out and go up a notch to AMBER/GREEN, as it seems to have good visibility & order book, and I like the “continuous improvement” programme. So it seems likely that profits continue rising. Although this type of business will inevitably have the ever-present risk of something going wrong with big contracts. You only have to look at the chart for 2021, to see how quickly things can unravel, although the fundamentals seem back on track now.

10-year chart -

Eco Buildings (ECOB)

Up 15% to 7.75p (£6m) - Letter of Intent - AMBER/RED

Eye-catching RNS today says its received a letter of intent from the Dominican Republic to manufacture 10k prefabricated houses in ECOB’s automated factory in Albania, with anticipated gross revenues of $237m over 5 years! If that happens, then this £6m market cap could be a big riser. However, the problem is that it has a stretched balance sheet, with hardly any cash (running on fumes with small placings) and c.£5m of debt. So it clearly needs to refinance properly before it could ramp up production. Note that 4 large shareholders own almost two-thirds of the shares, so de-listing risk could emerge. Has to be seen as highly speculative at this stage. Could be a mad punt, but I’d rather wait for the LoI to turn into an actual order, and the company to refinance.

Thank you for yesterday’s report, Paul, but do give yourself time to get better. I think we all understand you are a mere mortal and things happen. Glad you are feeling better.

Hope you are feeling better Paul! No problem taking time out I think we all understand and can relate. I find the stomach bugs the worst as I’m unable to function like a human and end up flopped out on the sofa for days.