Wed 14 May 2025 - Paul Scott's Small/Mid Cap Value Report

Alun's snapshot up at 07:40. HAT takeover! Main table v1 up at 07:54. Starters: CPG, IMB, PSN, BRBY, VTY, TCAP, SVS, KLR, SPI, MSLH, RNK, NIOX, GMS, VTU, VANQ, JNEO Mains: HAT, VIC, TPX, SPX, GAMA

Good morning from Paul, Dave, Jon, and Alun!

Today’s report is now complete at 13:54. Podcast later, first I need a nap!

What a remarkable recovery we’ve seen in markets. Is the tariffs panic over? It could be a new bull market, or a bear market rally, we’ll only find out after the event. For me though, focusing on value, GARP, and dividends, that seems a solid foundation for further rises maybe? Particularly as the path of interest rates is now apparently downwards, making equities relatively more attractive vs cash & bonds (new purchases of them anyway).

I hope you held your nerve, and didn’t get shaken out of good stocks. It’s expensive moving in & out of small caps, due to the wide spreads, and broker commissions. Plus you’ve got to get the timing right, and have to find a willing buyer or seller - not always possible with smaller shares. Hence why I think sitting tight for our long-term positions is usually best.

My SIPP doesn’t cause me any stress at all, irrespective of the value of my pot, as I don’t intend drawing on it for the foreseeable future (only in the event of serious ill health), and park my long-term growth shares in it. So it’s only a problem if something goes wrong with the fundamentals of the companies I’ve invested in.

It’s my geared account that gives me sleepless nights in downturns. I lost most of the (small amount of) capital in it during the recent panic, but it’s fully recovered now. I definitely need to let the gearing reduce by banking some profits now, but keep finding new things to buy, almost on a daily basis. It’s so tricky isn’t it!

Errors - thank you for messages sent to me through Substack when you spot a typo or factual error. I want to get everything 100% right, so please do flag up any mistakes in the written reports. Hoenir kindly spotted a typo in the table, which I’ve now fixed, many thanks!

Podcasts - I usually say something the wrong way around in most podcasts (eg. bear market when I mean bull market, etc), but you can tell from the context what I meant, so I don’t worry about correcting those, as I don’t know how to edit the audio, so it just goes out “as is”.

H&T (HAT)

458p (last night’s close) £199m - Recommended Final Cash Acquisition (of H&T by FirstCash Holdings) - Paul - PINK

Excellent news here, with an agreed takeover bid at 650p cash + 11p final dividend already in process (so not a valid part of the takeover price, in my view, as shareholders would have got it anyway).

The 650p figure is a healthy 42% premium to last night’s close.

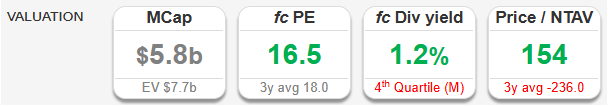

The acquirer is yet again a US company, FirstCash, whose shares are on a much higher rating than HAT - eg -

FirstCash (NASDAQ:FCFS) - note that the standard ShareScope subscription includes international shares -

H&T (LON:HAT) -

Hence the attraction in buying HAT, even at a 42% premium price, is obvious, as that’s still dirt cheap compared with FCFS’s own valuation.

Once again we’re reminded of how cheap many UK shares are, relative to those in the USA.

What disturbs me is that we’re today told for the first time that takeover talks have been going on since Dec 2024, with a series of proposals being rejected by HAT until the latest deal was accepted. This has all been done in secret, whilst shares trading normally, thus creating a false market in HAT shares for over 4 months. Is anyone seriously going to claim that the news didn’t leak out at all, when hundreds of people would have known what was going on, and could have tipped off friends/family etc? The takeover rules in this country are a joke.

There was a strange surge up in share price on 8/5/2025 on no news, which stuck - looks very much like insider dealing to me.

Anyway, let’s not sour the understandable delight this morning for shareholders - very well done!

I’m glad we strongly highlighted the value in HAT shares here - this deal could have paid for your substack subscription here, for the rest of your life! :-D

Also I published a CEO interview here on 5 Mar 2025, which was well received, and I hope some of you made a bob or two on this share!

Well done to Chris Gillespie for negotiating a cracking exit for shareholders.

Random re-rating, just before a takeover bid! Not even remotely suspicious of course -

Click here for my special signup deal for new accounts at ShareScope. It’s terrific software, and helps fund our writers here from commissions earned.

End of free section.

Keep reading with a 7-day free trial

Subscribe to Small/Mid Caps with Paul Scott to keep reading this post and get 7 days of free access to the full post archives.