Wed 15 Jan 2025 - Paul Scott's Small/Mid Cap Value Report

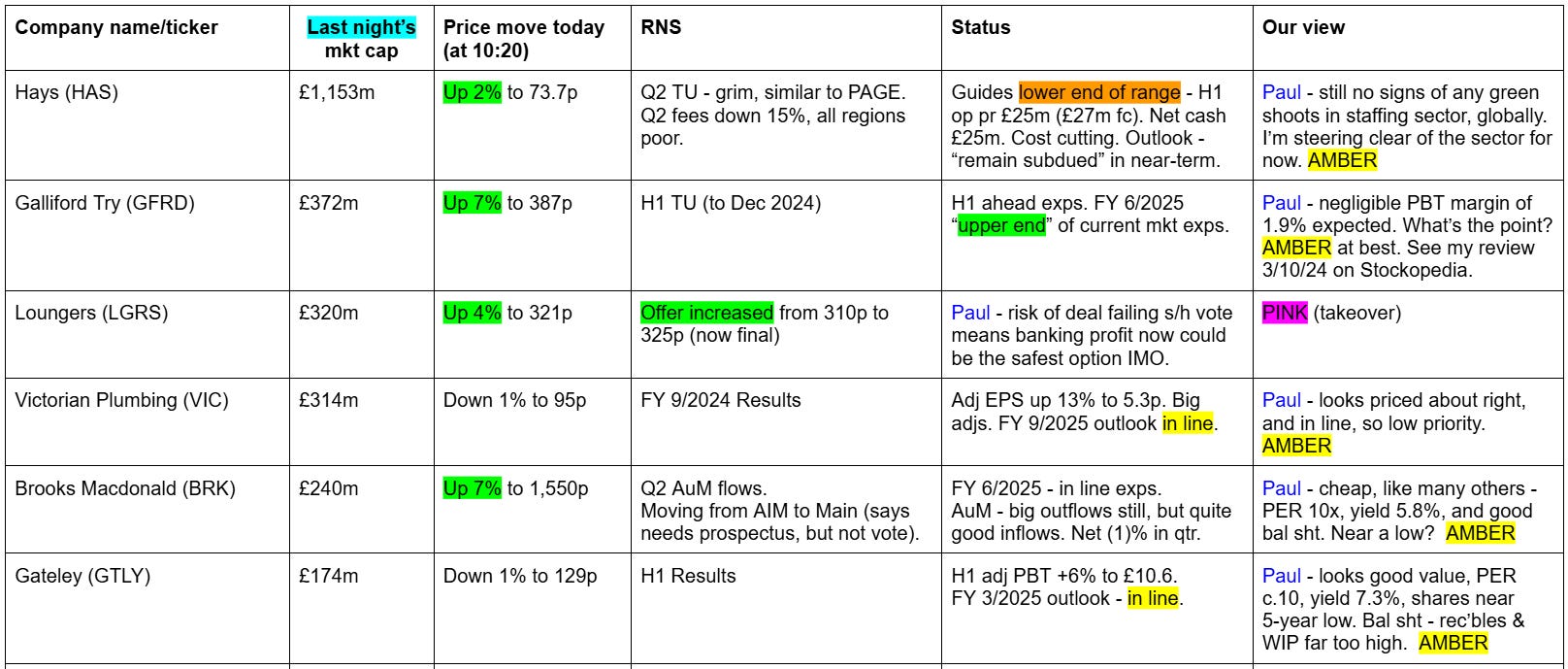

Free: HAS, GFRD, LGRS, VIC, BRK, GTLY, BOOM, XAR, NXQ, WINK, FIN Premium: VTY, GNS, CURY, FDEV, CARD, AMS

Good morning from Paul & Dave!

UK inflation figures today (for Dec 2024) are a bit better than expected (CPI was 2.5% in 12 months to Dec 2024 vs 2.7% expected - EDIT - another article says 2.6% was expected). That’s helping interest-rate-sensitive shares today, and forces me to issue a warning - shares can go up, as well as down! ;-)

I woke up at 04:30 fretting about Card Factory not being covered yesterday, so there is now a section on it below! Always better to do articles early when I’m fresh, rather than struggle to concentrate at night when I’m too tired, and prefer to be watching “The IT Crowd” or “The Brittas Empire” on DVD - comedy from the days when they were actually funny, is a great way of unwinding and getting a good night’s sleep I find.

InvestorMeetCompany Audio Archive - I’ve just discovered they do an audio podcast of the recordings too, perfect! Search for that title, and it should come up. I have loads of backlog to watch, and going for a brisk walk is much better than more hours hunched over a computer screen! I’m just passing this on to you, as useful info.

MrC's Smallcap Sweep. Evil spirits

◄DIS,BTC,LGRS,QED,FUM,CREO,HAS,BRK,ASC,FIN,BOOM,BANK,VNET

◄Distil (DIS)► Q3-Dec rev down 59% to £233k. Blames weak spirits market. In response co "moving our full UK distribution, including the on-trade, to long-term partners, Global Brands, who have been producing and successfully selling the RedLeg ready-to-drink can since 2019." [SP=0.11 Cap=2m]

◄Vinanz (BTC)► the latest David Lenigas float signs a purchase order to increase its Nebraska US Bitcoin mining fleet to 100 miners. Also plans to expand in Texas. Baaargepole. [SP=20.4 Cap=52m]

◄Loungers (LGRS)► rec 325p increased offer, from 310p. [SP=322 Cap=335m]

◄Quadrise (QED)► terms of License and Supply Agreement with Valkor changed. Initial licence fee now paid in two stages: only $350k up front and $650k in Dec. Other changes. Valkor has secured the minimum project finance required for the project of $15m min. [SP=6.04 Cap=107m]

◄Futura Medical (FUM)► a whole new avenue of innuendo opens. Co gets positive results of the WSD4000 Home User study for the treatment of sexual dysfunction in women. Shows a "notable uplift from the baseline". Plans Early Feasibility Study during H1 2025. [SP=30 Cap=91m]

◄Creo Medical (CREO)► first robotic-guided microwave ablation of cancerous lung tissue cases have commenced. "The Pioneer Programme will continue to roll-out throughout 2025 to support the collection of clinical evidence ahead of the sites entering a commercial phase." [SP=18.18 Cap=75m]

◄Hays (HAS)► Q2-Dec net fees down 15% and 12% LFL. "Temp & Contracting was sequentially stable through the quarter and our New Year 'return to work' will again be important so we are closely monitoring activity levels. Perm net fees slowed but it is too early to say if recent weakness reflects a more sustained market slowdown." Guides H1 pre-exceptional op profit c.£25m, towards the lower end of the consensus. [SP=72.4 Cap=1152m]

◄Brooks Macdonald (BRK)► guides FY in line. Intends to move from AIM to the Main Market to enhance co's corporate profile and make its shares available to a broader group of investors. [SP=1450 Cap=240m]

◄ASOS (ASC)► yet another retailer's grand US plans turns to dust Co will mothball its Atlanta distribution centre in H2 FY25. "US customers will be served from ASOS' automated UK fulfilment centre in Barnsley, and through a smaller, more flexible local US site." Guides £10-20m PA EBITDA benefit from FY26 onwards. [SP=377.6 Cap=451m]

◄Finseta (FIN)► guides FY-Dec rev up 19% and U/L rev up c.26%. Adj EBITDA up 18%. Outlook is confident. [SP=42.34 Cap=24m]

◄Audioboom (BOOM)► guides FY-Dec rev up 13%. Adj EBITDA c.$3.4m significantly ahead of market expectations. Contracted rev for FY25 already over $54m. [SP=403 Cap=66m]

◄Fiinu (BANK)► heads of terms for its first white-label Banking-as-a-Service (BaaS) deal with a UK Bank. [SP=0.67 Cap=2m]

◄Vianet (VNET)► strategic data solutions contract win with a major global brewer. "Includes new installations of the Group's Beverage Metrics draught beer monitoring solution." [SP=107 Cap=31m]

In line: FSTA, CPP, VTY, NXQ, WINK

Today’s free section list

(in mkt cap order, largest at the top. Blue denotes no further comment is planned)

End of free content here.

Keep reading with a 7-day free trial

Subscribe to Small/Mid Caps with Paul Scott to keep reading this post and get 7 days of free access to the full post archives.