(FREE!) Friday 18 July 2025 - Paul Scott's Small/Mid Cap Value Report

Alun's Snapshot up at 07:27. Starters: GSK, BRBY, BPT Mains: CHH, SNR

Welcome to Free Friday - my shorter Friday report (usually quiet news day, exceptionally quiet today), written by just me (with help from Alun), which goes out free to everyone. Please consider upgrading to premium if you like our work, the reports are much larger on Tue, Wed & Thu of course, as the City has more-or-less gone onto a 3-day week these days, so RNSs tend to be concentrated into those 3 days.

Remember, only one good share idea here could easily pay for a lifetime of subscriptions.

Also, if you could re-Tweet, re-Stack, and re-anything else to spread the word, that would be very helpful, as I don’t do any advertising.

ShareScope Features

I’m already bored with today’s news, so thought I’d do something more interesting (hopefully!) So I’ve made another video showing how I use ShareScope when the market opens, as a tool to pick up price-moving news stories that might otherwise have been missed.

We earn commissions from ShareScope, which helps me pay the writing team here, if people sign up using my affiliate link here, which also gives a useful first-year discount for new accounts. Why not give it a whirl with a free trial?

ShareScope is absolutely brilliant, once you get the hang of how to use, and customise it, but that does require some time & effort. Hence why I thought showing off features I’ve found useful might be of interest.

(Tip: if you enlarge the Youtube video, the screen resolution becomes much clearer)

Thank you to subscribers here who have joined ShareScope using my affiliate link, it’s very much appreciated.

Churchill China (CHH) - Paul holds

Down 3% to 465p (£51m) - Broker update - Paul - AMBER/GREEN

Just a quick update today, as I reported on CHH’s profit warning in both yesterday’s article and podcast.

I couldn’t give an overall view yesterday, because we didn’t have access to the new broker update.

Many thanks to my co-writer here Jon, who flagged to me this morning that the broker consensus figures had updated, and there’s only one broker covering, so it should be accurate.

Forecast EPS for FY 12/2025 has been reduced from 58p to 41p. That’s not too bad in my opinion, I was half-expecting something worse, given the various factors CHH mentioned yesterday which had caused it to significantly under-perform from May onwards.

So now we can value CHH shares again. At 465p, it’s now valued at 11.3x PER, and with a particularly strong balance sheet, as explained in yesterday’s report.

Bull view - it’s very strong financially, with shares trading below NTAV. The PER is now modest at 11.3x, and there’s potential for trading to improve once economies are through this soft patch.

Bear view - various headwinds mentioned yesterday mean profits are now falling, and it could get worse. Sector recovery (hospitality) may not happen any time soon, if at all. Maybe competition is eating into CHH’s market?

Paul’s view - I’m happy to take a c.2 year view, and knew there was a risk of a profit warning when I bought recently close to 500p. I’m looking for sub-400p to double my position size.

I see CHH as a decent business, that makes £8-10m pa profit most years. So it should recover, and personally I find the valuation now more attractive. So I’m comfortable at AMBER/GREEN. Obviously my judgement could be through rose-tinted glasses, as I’m an existing holder.

MrC's Smallcap Sweep: This is Captain Twerp of the Useless Enterprise.

AGFX, CRS, CPX, GST, ELEG

Note: 👍 👎 ❓mean positive, negative or mixed/confusing. No symbol = neutral. All Alun's opinion only on each specific RNS, not the company itself.

◄Argentex (AGFX)► 👎 the shallow grave is ever closer for this colossal screw-up. Co 'voluntarily' agrees with FCA to cease all regulated activity, to not register and onboard new customers, and to not open any new foreign exchange trades. [SP=2.45 Cap=3m]

◄Crystal Amber Fund (CRS)► has received cash from De La Rue takeover. It is "consulting with shareholders and advisers over the future structure of the Fund, as well as considering strategy and ensuring returns to shareholders are made in a timely fashion whilst continuing to maximise value from its investments." [SP=157.72 Cap=103m]

◄CAP‑XX (CPX)► 👍 update re. collaboration with SCHURTER - project now approaching c.$2m of potential revenue to CAP-XX. Rest is just a recap and chest-beating. [SP=0.24 Cap=14m]

◄GSTechnologies (GST)► sends notice of arbitration to Choo Seet EE and Zheng Kang Wen Mervyn, the sellers of Semnet. claiming sellers have acted in breach of their non-compete undertakings. [SP=1.27 Cap=30m]

◄Electric Guitar (ELEG)► 👍 cash shell makes non-binding agreement to acquire Dunbar Energy in an RTO. Dunbar "aims to utilise coal mine methane and stranded gas for power generation, supporting the growth of datacentres and generating carbon credits". [SP=0.07 Cap=2m]

Hardly any news today, this is all I’ve got so far at 07:48 - v2 with price moves, 09:31 - final update at 18:08 -

In more detail below -

Paul’s Section:

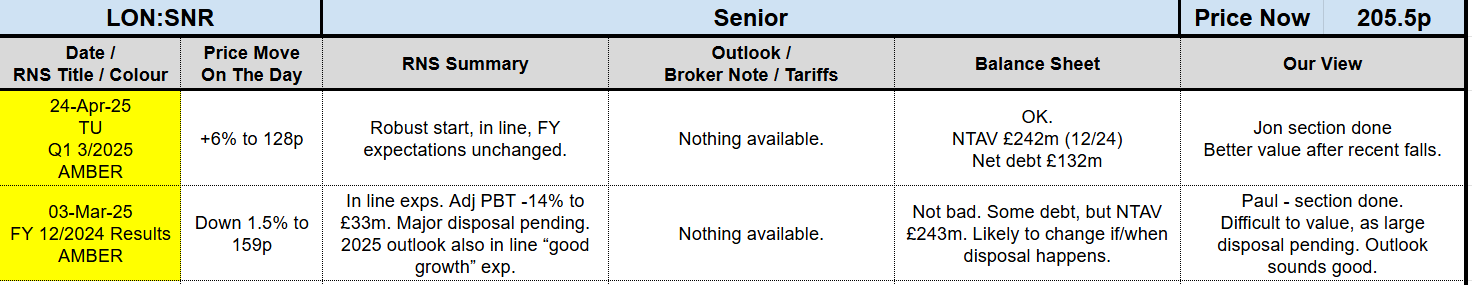

Senior (SNR)

Up 9% to 205p (£849m) - Disposal of Aerostructures & £40m Buyback - Paul - AMBER

“Senior plc ("Senior" or the "Group"), an international manufacturer of high technology components and systems, is pleased to announce that it has reached a binding agreement to sell its Aerostructures business ("Aerostructures") to Sullivan Street Partners, a UK-based mid-market private equity investor, for a total enterprise value of up to £200m (the "Transaction").

Following completion of the Transaction, the continuing Group will be a high quality, pure play fluid conveyance and thermal management ("FCTM") business…”

Checking our previous notes below, this disposal had been pending for some time, although without us knowing any financial details. The 9% share price jump this morning suggests that the market’s initial reaction is favourable.

Our previous notes -

Advantages of this disposal, per Senior - if getting rid of it is so positive, I’m wondering why the buyer wants it?! -

Simplified & more focused group, with “structurally higher operating margins”

Lower capital intensity

Reduced net debt & lease liabilities

Improved ROCE and shareholder value

Stronger operational cashflow conversion

“Optionality” for shareholder returns, or investment

Transaction key details -

Buyer is private equity firm Sullivan Street Partners.

EV up to £200m (13.1x EBITDA - sounds a good price, but that’s assuming the earn out is achieved)

Initial consideration is £150m + £50m payable in H1 2026, if 2025 EBITDA performance is met.

Upfront net cash proceeds of £100m, less £12m cost (seems high) = £88m cash up-front. Presumably this means Aerostructures is taking c.£50m net debt with it, if I’ve read that correctly? The company also refers to leases as debt, which personally I wouldn’t have included in the EV calculation, but it sounds like they might have done.

Accretive to Senior’s operating margin, but of course the absolute level of future group profits would be expected to fall, but Aerostructures seems to have made an operating loss in both 2024 and 2023.

Completion date, end of 2025, which seems slow.

Post-disposal targets, which it says were previously communicated in March 2025. This impresses me, that management seem focused on strategic financial goals -

Pro forma 2024 results - this table below is really helpful, as it shows the before & after results for 2024, actual vs pro forma (pro forma being re-worked 2024 results, as if the disposal had already happened). This seems to be showing that the disposed business was loss-making in 2024. That seems odd, so I’m guessing it must have had an unusually poor year in 2024, as nobody would want to buy a loss-making business for up to £200m! (unless it has a bitcoin treasury policy maybe?!)

Broker updates - nothing available to us yet, so we’ll have to wait for data to feed through in updated consensus numbers.

Paul’s opinion - this looks interesting. Just using the information in today’s announcement from Senior, it seems to have achieved a good price from disposing of a loss-making part of the group.

Presumably the buyer thinks that the Aerostructures business it is buying has good potential, so maybe the 2024 and 2023 operating losses are not representative of the outlook for the disposed business?

The stock market likes this deal, with Senior shares now breaking upwards, which a lot of traders like (chart breakouts).

Overall, I quite like the look of this disposal, it seems to clean up Senior, and improve its margins and key measures like ROCE in future.

That said, valuation still seems quite punchy, especially after a very good bull run in this share. So I’ll remain on the fence with AMBER.

Click here for my special signup deal for new accounts at ShareScope. It’s terrific software, and helps fund our writers here from commissions earned.

Hi Freebie guys. Just a shout out for the quality of Paul's's daily Podcasts. Normally about a half hour duration but treated last night to an bonus golden hour full of invaluable company insights delivered in his inimitable style. Treat yourselves.

BPT Bridgepoint Group reaffirms FY guidance, capital deployment and fundraising on track ➡

CRS Crystal Amber Fund receives final £18mn payment on sale of De La Rue, considering capital return to shareholder options ↗

SNR Senior sells Aerostructures business and announces £40mn share buyback ⬆

VALT Valterra Platinum decline in earnings for H1 of ~90% due to 25% decline in PGM sales and one-off demerger costs ↘

RKT Reckitt Benckiser agrees to divest Essential Home business to Advent for $4.8bn (will retain 30% stake), anticipates $2.2bn special dividend on completion by year end ↗

BRBY Burberry Group Q1 retail sales -1% beats expectations of -3.7%, turnaround on track ↗