Fri 20 June 2025 - Paul Scott's Small/Mid Cap Value Report

Alun's Snapshot up at 07:35. v1 table at 07:53. Starters: BKG, DORE, ECEL, CARR, LORD, ORCH, PR1 Mains: REC, CYK

Good morning from the Free Friday team - Paul & Alun!

Since news is usually sparse on Fridays, I give away the report and podcast, in the hope that it might keep some free subscribers engaged, and the odd one kindly converts over to premium most Fridays, thank you to those who do contribute towards my costs & recognise the value of our work - it keeps the show on the road!

Thank you also the excellent reader comments, which add a lot to the overall package. As I always say, investing is a team sport, with lots of good people throwing your ideas and knowledge into the pot.

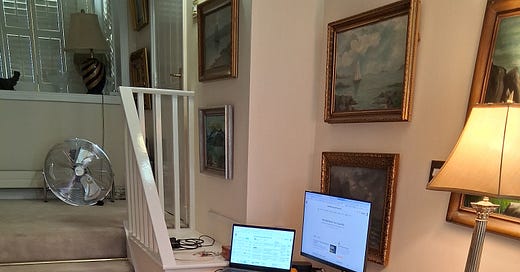

Here I am ready for the 7am RNS, with my 20-inch fans either side, they’re highly effective. Another fan-tastic day in the heatwave, hopefully! How long will it be before some companies start blaming the weather for slower sales? This is my London setup when I’m staying up here. Not ideal, but it’s good enough.

GFK Consumer Confidence

I have a look at these UK consumer confidence numbers when it’s not busy with other things. Figures for June are out this morning, here’s the link.

I hope it’s OK to reproduce the table below, with thanks to GFK and NIQ for publishing this long-running survey.

For me, the only significant line is “Personal Financial Situation over the next 12 months”, and at a slightly positive +2 level, that seems reassuring.

As we mentioned the other day, possibly in a podcast, UK households currently have a high savings rate. So they’ve got firepower to spend more, when confidence improves. Maybe the outlook isn’t quite as gloomy as the mainstream media like to constantly tell us? Only time will tell, nobody knows, and too many people pretend to know!

MrC's Smallcap Sweep: Money trees growing in Orchard

ORCH, DORE, SURE, NARF, CYK, VAL, IDHC, REC, LORD

Note: 👍 👎 ❓mean positive, negative or mixed/confusing. No symbol = neutral. All Alun's opinion only on each specific RNS, not the company itself.

◄Orchard Funding (ORCH)► 👍 guides FY-July earning beat of over 20%. Cites strong insurance premium finance market and reductions in interest rates. [SP=50.9 Cap=11m]

◄Downing Renewables & Infrastructure Trust (DORE)► 👍👍 rec offer of 102.6p, a 24% premium. [SP=84 Cap=143m]

◄Sure Ventures (SURE)► 👎 Q1 NAV 168p/sh, down 7% over the Q, largely due to FX swings on value of Infinite Reality. Infinite Reality? I don't know how much more reality I can take. [SP=85 Cap=7m]

◄Narf Industries (NARF)► CEO $3m loan facility extended another year to July [SP=0.49 Cap=8m]

◄Cykel AI (CYK)► 👍 Monthly Recurring Revenue up 68% over the past four weeks mainly due to Lucy, its autonomous recruitment agent. This is another outfit that's jumped on the promoter's vehicle du jour, the Bitcoin Treasury. [SP=2.73 Cap=13m]

◄ValiRx (VAL)► 👍 Ambrose Healthcare exercise option to licence VAL401 in return for 576k shares in Ambrose (not listed) plus clinical and commercial milestone payments up to £16m + royalties. [SP=0.51 Cap=2m]

◄Integrated Diagnostics (IDHC)► acquires CAIRO RAY for Radiotherapy, a radiology and radiotherapy facility in Egypt for EGP400m = c.£6m. [SP=0.36 Cap=208m]

◄Record (REC)► FY-Mar. Outlook - "highly dependent on the closing of large complex deals currently in the pipeline but we anticipate FY26 revenue growing low single digits and EPS flat". In line? [SP=57.2 Cap=114m]

In line: LORD

Here’s my first stab at the news summary at 07:53 - v2 at 08:57 - v3 at 11:23 - final version at 16:45

(click picture below to enlarge)

In more detail below:

Record (REC) - Results FY 3/2025 - AMBER/GREEN

Cykel Ai (CYK) - 68% Sales Growth - NO COLOUR

Paul’s Section:

Record (REC)

Down 6% to 54p (£104m) - FY 3/2025 Results - Paul - AMBER/GREEN

Record plc, the specialist currency and asset manager, today announces its audited results for the year ended 31 March 2025 ("FY-25").

My knee-jerk reaction to the collapse of Argentex recently was to avoid anything to do with forex, hence the previous drop from green to amber below.

Also an own-goal from REC itself, where its Q4 TU below was deliberately ambiguous, didn’t help.

Now the dust has settled, and the company previously confirmed that it takes “no market or counterparty credit risk”, let’s take a look at it today with fresh eyes.

Others have pointed out that the business model at REC (fund management involving forex) is very different from Argentex (forex payments processing), which blew up because of incompetent management that allowed a ruinous mismatch to emerge between client and supplier margin calls.

Although I still worry that any forex-based business model that involves gigantic numbers, possibly could contain some unforeseen risk. We don’t have to buy/hold any share, so even if fears are unfounded, it’s not a problem to say no, and move on to the next thing.

Previous coverage here:

AuM (assets under management) down 1% to $100.9bn (I seem to recall that a lot of this is notional, gross value of derivatives, so not actual client funds as such)

Revenue down 8% to £41.6m - lower performance fees blamed, also note a big -70% drop in fees from “Custom Opportunities”.

Profit before tax down 15% to £10.9m (a small miss against broker consensus of £11.3m)

Tax charge has halved, from £3.6m to £1.8m, which flatters PAT (down only 2%) and EPS, up 4% to 5.03p, which is spurious - it’s only up due to lower tax.

Outlook: this sounds a little wobbly to me, perhaps with a heightened risk of a profit warning if they don’t close the big deals in the pipeline -

“We have started FY-26 with a well-positioned pipeline. Over the medium term, we expect the deployment of new funds in the Private Markets space in particular to drive revenue and EPS growth.

The outlook for the current year is highly dependent on the timing of closing the large and complex deals currently in the pipeline, but we are anticipating low single digit revenue growth and flat EPS year on year.

Dividends: generous divis are the main reason to hold REC shares, and it’s been a reliable payer, with impressive growth too. Here’s an extract from the ShareScope “Dividends” tab -

Today the commentary says this about future divis. Is it warming us up for a possible cut if the large pipeline deals don’t complete? It sounds a bit like that to me, so I wouldn’t assume the yield is rock solid - it may be, but there’s some doubt -

“Recognising the importance of the dividend to investors, and the uncertainty of timing of new revenue growth, we remain committed to paying a healthy ordinary dividend while always balancing that with the aim of maintaining a strong balance sheet.”

Total divis of 4.65p for FY 3/2025, divided by 54p share price, gives a wonderful 8.6% yield, but with the potential for that to be cut if something goes wrong, as it’s only just covered by earnings.

Presentation slides: it says these will be published on the website, but aren’t there yet. Here’s the link for when the slides do appear.

Balance sheet: is excellent NAV of £29.1m becomes NTAV of £28.7m after a small deduction for intangible assets.

It’s sitting on cash of £13.3m (including money market deposits), which is net cash, as there are no borrowings, and I ignore lease liabilities.

Working capital (receivables & creditors) are modest, which reassures me it’s not doing proprietary (risky) trading using its own balance sheet - if it did, those numbers would be a lot bigger.

Providing nothing unforeseen goes wrong, this balance sheet seems robust.

Cashflow statement: fairly simple - it generates cash, and pays it out in divis!

Note that capex increased from a negligible £29k in 3/2024 to £2.16m in 3/2025 - leasehold improvements mostly, and new computers, plus fixtures & fittings. So looks like they’ve treated themselves to a spangly new office! The figures are not excessive though.

Shareholders: dominated by the founder, Neil Record (doesn’t seem to be a Director any more), at 27%. Also Premier Miton (5.3%), Schroder (3.8%), and plenty of private investors - since II hold 5.7%, and Hargreaves Lansdown 3.4%. Directors hold c.1.5%.

Paul’s opinion: I do quite like the numbers here, even though PBT was down 15%.

The hefty 8.6% dividend yield might come under pressure, and the outlook sounds a little wobbly.

The balance sheet looks good to me, with decent net cash.

The trouble is, I don’t think we can easily judge (if at all) what the future holds for Record, and since performance is uncertain, how can I value it?

It does look cheap though, with a great divi yield, and a nice balance sheet, PER of about 10x, so I think it has to be AMBER/GREEN this time.

Click here for my special signup deal for new accounts at ShareScope. It’s terrific software, and helps fund our writers here from commissions earned.

Cykel Ai (CYK)

Up 16% to 3.15p (at 15:32) - mkt cap £16m - 68% Month-On-Month Growth - Paul - NO COLOUR

Here’s another company that is combining the hype of Ai and Bitcoin. I think there’s likely to be very little substance to anything like that, and they’re probably speculative financial promotions. But let’s have a look at the fundamentals, so we are armed with the facts if we do decide to have a punt on anything like this.

Key points -

Claims 68% month-on-month recurring revenue growth, but declines to say what the numbers actually are, so it could be anything! £200 to £336 is 68% growth, but it wouldn’t pay for much.

Growth driven primarily by its “Lucy” service, which it says is an “autonomous recruitment agent”. Googling that phrase brings up lots of companies offering Ai recruitment services.

My guess of £336 revenue might have been ambitious, because CYK actually reported just £817 revenue for FY 1/2025.

Administrative expenses were £1.6m. So it would need to increase revenue almost 2000x to reach breakeven, assuming no additional expenses.

It had burned through almost the entire £1.4m cash pile, with only £119k left at 1/2025.

NTAV was £-65k at 1/2025.

Fundraise of £800k was done in Feb 2025, at 3.2p

Another fundraise of £750k (before costs) at 2.3p was done recently, on 9/6/2025.

Announcing its “Bitcoin Treasury Policy” strikes me as a pure ramp (red flag), probably designed to get investors buying the shares, as there’s no substance to it - given that CYK doesn’t have any cash reserves to speak of. So who cares if they hold it in £, $, or Bitcoin?! Buying Bitcoin just adds risk, as far as I’m concerned, as that’s a giant bubble.

The “Lucy” service sounds interesting, but there are tons of competitors doing the same sort of thing - Ai co-workers. What we need is someone to try out Lucy, and tell us if it’s any good or not, and how it compares with the many competitors out there?

CYK’s website shows that pricing is free to try it out, or a “starter” package is $49 per month, or the “pro” package is $199/month, suggesting I think that it’s a me-too operator.

Paul’s opinion - the figures suggest this is basically a startup, with hardly any cash, and negligible revenues, so it’s burning cash and will need more placings probably.

So this seems a complete speculation, with almost no commercial substance to it yet. Hence a £16m market cap looks wildly ahead of reality.

Good luck to anyone punting on this, but there’s little to no commercial substance at all, at this stage. Hence it cannot be rationally valued.

I can’t give it a colour, as there’s nothing to value. Just hype, and hope. I’ve no idea what the share price will do, it could do anything. Ai/Bitcoin hype minnows are popular at the moment, so it could multi-bag, I’ve no idea. But treat it as what it is - just a pure speculation at this stage. And remember that people buying in the placings will likely be hoping to flip the stock at a profit, and pump it on bulletin boards to suck in mug punters who like fashionable stories. I’ve seen it all before, many times, over the last 25 years, this perfectly fits that mould. Hyped up speculations now are usually the 99% portfolio losses of a few years’ time.

The chart looks like this (below) because it was reversed into an existing listed shell, previously called Mustang Energy.

Huge thank you to both Pauls - 2 P's in a Pod (Cast) I really enjoyed yesterday's VOX Markets presentation and I especially liked the 2 summaries of the conversations you had with Cordel & Bango management - really very useful and insightful. But the best bit, in my opinion, was the fact that both Paul's agreed they would still be doing this in 30 years time and still loving it - I certainly hope to be with you both on that particular voyage! (Makes a change from the overused journey!)

Good morning Paul, after seeing the picture of your London set-up I thought the image underneath was your garden. All the best

PD